Crude oil is one of the most important commodities in the world. Being the precursor material for fuel, plastics and other essential petrochemicals, crude oil is the foundation upon which the modern age is built.

It is also an important instrument in the global economic system. Its trading price is referenced as a major benchmark, and changes in crude oil price can have significant impact in virtually every economy that takes part in the global financial system.

Two of the most significant crude oil benchmarks are Brent crude, and West Texas Intermediate (WTI). While the Brent tracks prices of crude oil primarily extracted from the North Sea region, the WTI tracks prices of oil produced in the US.

In this article, we will learn about WTI crude oil trading, what affects prices, and the various instruments that traders can interact with.

Key Points

- WTI crude oil, extracted primarily from the Permian Basin in the U.S., serves as a high-quality benchmark for American oil markets due to its low sulfur content and low density, making it a sought-after grade for its refining and transportation ease.

- Trading WTI crude oil involves futures contracts on the NYMEX, allowing traders to hedge against price volatility or speculate for profits, with significant price movements influenced by supply and demand, geopolitical tensions, and macroeconomic factors.

- The volatility of WTI crude oil prices, demonstrated through historical trends and predictions, underscores its sensitivity to global economic conditions and geopolitical events, offering both risks and opportunities for traders utilizing various trading strategies and instruments.

What is WTI crude oil? [1,2]

WTI crude oil is the label used for crude oil that is extracted from US territory, primarily the Permian Basin. The crude oil is drilled mainly in Texas, North Dakota, and Louisiana, and refined in the Midwest and Gulf of Mexico, before arriving at Cushing Oklahoma for physical exchange and price settlement.

WTI is considered a high-quality crude because it has low levels of sulphur and low density – qualities that make it easier to refine and transport. Thus, as a “sweet” and “light” crude, WTI is able to fetch a higher price over crudes that have higher sulphur content or viscosity.

The high quality and geographical region of origin render WTI the ideal candidate as the prime benchmark for the American oil market. It is the underlying commodity of the New York Mercantile Exchange’s (NYMEX) oil futures contract, and serves as a reference price for buyers and sellers.

Together with Brent, WTI is considered one of two most important oil benchmarks. The difference in prices between the two is known as the Brent-WTI spread.

History of WTI crude oil [3,4]

WTI crude oil is mostly made up of crude extracted from the Permian Basin, upon which the states of Texas and New Mexico sit. Thus, to understand the history of WTI, we should take a look at the history of oil and gas in Texas.

The discovery of oil in the Permian Basin can be traced back to 1921, when a Mitchell County, Texas, discovery well in the eastern Permian opened the Westbrook field to production. But it wasn’t until 1923 when Frank T. Pickrell and Haymon Krupp drilled their Santa Rita No. 1 oil rig near Big Lake, Texas, that the true beginning of the oil boom in the Permian Basin began.

During the 1930s, oil production in the Permian Basin continued at high levels, even through the challenges created by the Great Depression. In fact, a record 92 million barrels were produced in 1938, making the Permian Basin the largest oil-producing region in the United States.

The onset of World War II saw a spike in demand for oil, bringing the spotlight back to the Permian Basin. Post war, the region saw significant growth, thanks to new technology and seismic surveys that could identify and extract oil and gas reserves that were previously inaccessible.

By the 1950s, the Permian Basin saw its first peak, with production levels exceeding previous levels. However, from the 1960s to 1980s, major oil companies began their exodus from the Permian and other US oil plays, in favour of offshore and overseas fields instead. The 1970s also saw challenges such as decreased output from mature fields, and stricter environmental regulations.

The advent of hydraulic fracturing brought renewed vitality to the Permian Basin, when in 2010, producers started employing the process – along with 3D seismic imaging – to great success. By 2018, By 2018, the Permian Basin became the most productive oil field in the US, producing over 4 million barrels per day.

The increase in production in the Permian Basin helped the United States lessen its dependence on foreign oil. Today, the Permian Basin maintains crude production in excess of 5 million barrels per day, with producers enjoying soaring profitability, even during the 2023 low of USD 70 per barrel for WTI crude.

What is WTI crude oil trading? [5]

Instead of the spot market, crude oil commodity sales take place on the futures markets. This serves to help traders anticipate the price of crude oil, avoiding the wild swings – and resulting economic impact – seen in oil prices during the oil crises of 1973 and 1979.

Consequently, WTI crude may be traded using futures contracts on NYMEX, such as the highly popular CME Group West Texas Intermediate (WTI) Light Sweet Crude Oil futures.

WTI crude traders use futures to hedge against price volatility, which can have downstream impact on profitability. Such traders include companies involved in the crude oil supply chain, including refineries, and petrochem suppliers, as well as those that operate in fuel-dependent sectors, such as airlines.

In contrast, retail investors trade WTI on a speculative basis for profit-driven motives. Such traders should avoid crude futures with physical settlement; that means that you’d need to take actual ownership of barrels of crude oil.

In April 2020 the price of the WTI crude oil futures fell to negative $37.63 per barrel shortly before expiration; meaning traders were willing to pay to avoid having to take delivery, due to storage facilities becoming as demand slowed down during the early stages of the COVID-19 pandemic [6].

Why trade WTI crude oil? [7]

As a major energy commodity, WTI crude offers traders many advantages. .

Diversification

Oil prices and equities have been found to have no correlation, which means the prices of both tend to move independently of each other. Therefore, investing in WTI crude can bring some diversification to a portfolio that is heavily focused on stocks.

However, investors must recognise that certain sectors, such as transportation and manufacturing, are more sensitive to the spot price of crude oil and take that into account when considering their portfolios.

Inflation hedge

Like all commodities, crude oil has its own intrinsic value, rendering it resilient against inflation. This means investing in crude during high inflation can be a way to keep up with increasing consumer prices, although high storage costs may present difficulties.

Hedge against stock market dips

As the primary driver for WTI crude is supply and demand, the commodity may be unaffected by downturns in the stock markets. Indeed, commodities such as crude have been found to perform well even as equities fall when interest rates increase.

Potential for speculation

As we will discuss in detail later, the price of oil has been anything but stable. This volatility creates ample trading opportunities for those who speculate on oil, provided they are willing and able to take the risk.

Historical trends of the WTI crude oil market

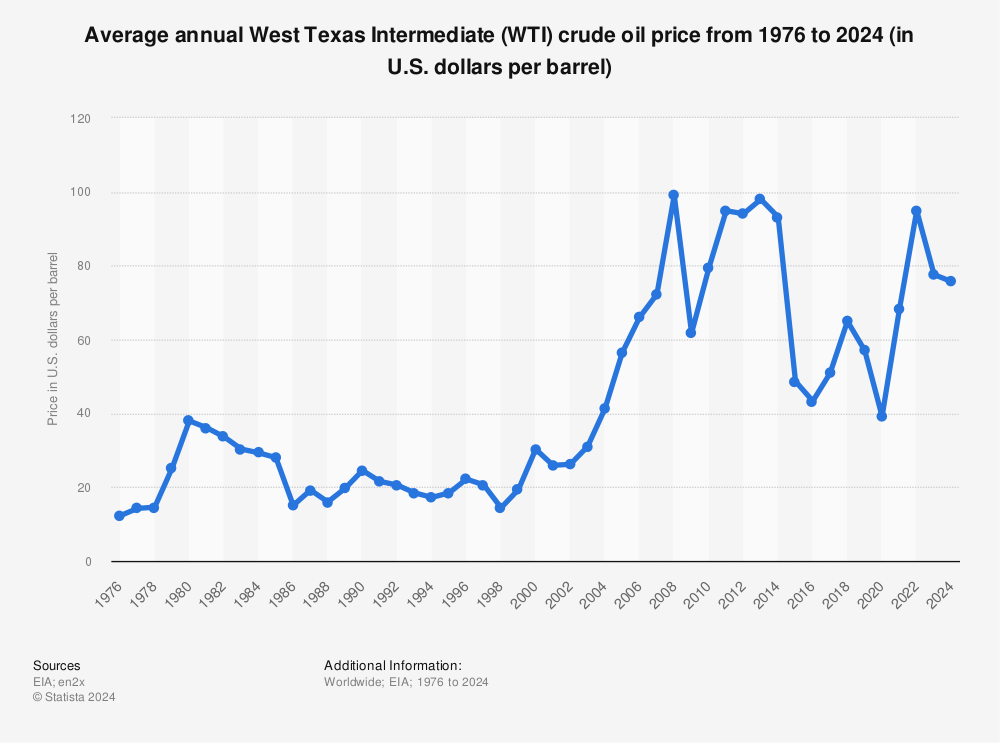

The chart above shows the average price of WTI crude oil from 1999 to 2024, in US Dollars per barrel.

As you can see, prices are highly volatile, ranging from as low as USD 20 to USD 100 per barrel in the past 25 years.

Let’s zoom in on a few recent high-volatility periods to understand what’s going on.

1999 to 2008 [8]

The average price of crude oil had been trending predominantly downwards throughout the 1990’s, with the 1998 Asian Financial Crisis bringing new lows. Oil prices had just started to recover when the 9/11 terrorist attack in 2001 in New York caused a temporary drop.

After that WTI crude oil prices rose steadily upwards, hitting an all time high of USD 100 per barrel in 2008. The reason for this dramatic rise boiled down to demand far outpacing supply, especially increased consumption by China and India. The rest of the world was also experiencing good economic growth, further driving the rise of oil prices.

2008 to 2014 [9]

The swift rise of WTI crude oil to unprecedented levels was put to an abrupt stop when the 2008 Financial Crisis took place, caused by the collapse of the subprime mortgage market in the United States. By 2009, WTI averaged USD 60 per barrel, a far cry from its heyday just months prior.

Over the next couple of years, oil prices recovered in tandem with improving global economic conditions. There was some volatility caused by political developments in the Middle East; in particular, supply disruptions during the Arab Spring in 2011 caused a temporary spike in oil prices again.

WTI crude prices remained high from 2011 to 2014, driven by continued geopolitical tensions, supply disruptions, and growing demand from emerging economies. But things would once again change, due to an unexpected development,

2014 to 2018 [10]

In mid-2014, producers in the United States pioneered hydraulic fracturing, causing a boom in shale oil production. This created a supply glut as the United States became the world’s largest producer of oil.

In response, Saudi Arabia led OPEC (Organisation of Petroleum Producing Countries) to increase production so as to protect market share. The sharp increase in supply and decrease in demand caused average WTI crude oil prices to fall sharply, leading to one of the most severe downturns in oil prices throughout 2015 and 2016.

Eventually the oil market stabilised, as production was reduced worldwide, allowing oil prices to mount a gradual recovery in 2018. This was attributed to improving global economic conditions, supply disruptions in Venezuela and other countries, and the re-imposition of sanctions on Iran by the United States.

2018 to 2022 [11]

After recovering in 2018, prices of WTI crude once again reversed, due to continued oil production in the United States. The downturn continued throughout 2019 and worsened when the COVID-19 pandemic began.

As the world went into lockdown, demand for oil slowed dramatically, causing oil prices to freefall. In 2020, US oil futures fell into the negative, a development that shook up the industry.

Thankfully, the pandemic was soon brought under control. As the world started opening up again, oil prices began to rise, powered partly by supply shocks that saw prices spike in 2022.

WTI crude oil prediction [12]

According to the Dallas Fed Energy Survey for Q1 2024, oil executives have a positive outlook for the price of WTI this year.

Prices per barrel are expected to range between a low of USD 70 and a high of USD 120, and the commodity is expected to end the year at USD 80.11 per barrel.

The latest round of predictions was slightly improved over December’s, which had WTI at a low of USD 51 and a high of USD 110, with an end-of-year prediction at USD 77.68 per barrel.

These predictions are based on the geopolitical situation remaining status quo. JPMorgan warns that crude oil prices could shoot up dramatically if Russia decides to cut oil production in retaliation to the sanctions levied against it for the invasion of Ukraine.

What affects WTI crude oil prices?

Being a core commodity with an essential role in the global economy, we can expect WTI crude oil prices to be affected by supply and demand levels, macroeconomic factors and geopolitical issues.

Supply and demand levels

Fundamentally, demand for crude oil is driven by strong economic growth and industrial production. Other significant drivers include transportation, such as logistics, aviation and personal transportation.

As such, high demand props up the price of WTI crude oil, and conversely, prices fall during periods of low consumption. This was clearly demonstrated during the COVID-19 pandemic, when global closures caused WTI crude futures to enter negative territory in 2020 [13].

Crude oil price is also sensitive to supply levels. Recall how the increase of US oil production due to the advent of hydraulic fracturing prompted the oil cartel OPEC to increase its own production in response. The sudden influx of oil caused a price crash in 2015 and 2016.

Macroeconomic factors and geopolitical issues [14,15]

Over the short term, WTI crude prices can be impacted by the mechanics of the futures market, and the release of macroeconomic reports.

As explained, crude oil trading takes place via futures contracts, which are binding agreements that gives one the right to purchase oil by the barrel at a predefined price on a predefined future date. Under a futures contract, buyers and sellers are obligated to fulfil their side of the transaction on the specified date.

This means that market sentiment can have an amplified effect on the pricing of futures contracts. If traders believe there is risk to upcoming supply, or spare capacity is running low, they will price their contracts accordingly.

Of course, traders do not simply make wild guesses in the dark; rather, they base their assumptions on official reports and data. Thus reports such as OPEC’s monthly oil report, the International Energy Agency (IEA) oil market report, and weekly inventory data from both the US Energy Information Administration (EIA) and the American Petroleum Institute (API) also play a role in the price of WTI crude oil.

Additionally, specific geopolitical issues can cause significant impact to crude oil prices. Some of these include:

- War with oil-producing countries or oil-producing regions. One recent example is the Russian-Ukraine war. Shortly after the invasion began, the price of crude oil shot up in March 2022 to above USD 110 per barrel.

- Cartel actions. OPEC is a group of 13 oil-producing countries that together control 40% of the world’s oil’s output. The organisation transparently attempts to exert control over oil prices by raising or cutting production. With the increase in US oil production, OPEC’s influence is no longer as severe, but their decisions continue to be closely monitored.

- Government policies. Green initiatives that mandate a reduction of oil and gas usage by industries could drive down demand for oil. This may cause oil producers to reduce supply in response, which may result in a price spike during periods of high demand, such as during winter.

Types of WTI crude oil trading

While the majority of WTI crude oil trading is conducted on the futures market, futures contracts are complicated and come with high risk, and may only be suitable for highly advanced or experienced investors.

Less experienced retail investors wishing to access trading opportunities in the oil markets may find it helpful to use less complex instruments such as ETFs, stocks or CFDs.

Oil Exchange-traded Funds (ETFs) [16]

Oil ETFs offer indirect exposure to the WTI crude oil market by tracking baskets of stocks involved in the crude oil production cycle: prospecting and extraction, production, distribution, and retail of crude oil and petroleum by-products, as well as the commodity itself.

There are several types of oil ETFs available on the market, differentiated by their areas of focus. Thus, it is important to understand the objective of the fund, and the securities that underpin it, so as to have a clearer understanding of how well it fits into your portfolio or investing objectives.

It should be noted that oil ETFs are best suited to a longer-term investing strategy, given the potential for high volatility within a short term. Oil ETFs are available to buy, one or sell through online brokers.

Oil and energy stocks

While oil ETFs offer access to baskets of oil securities, oil stocks allow investors to focus on specific companies or entities involved in the WTI crude oil market. This allows you to concentrate your position across a smaller number of well-performing oil or energy companies, without owning stocks you do not want.

Note that holding individual oil stocks can be more risky than a broad-based energy ETF, as there is less diversification, so losses may be larger than the market average. However, if all your picks turn in winning performances, you have the potential to make market-beating returns.

Another drawback of oil stocks is that you may also need to put in a higher capital amount in comparison. For a less capital-intensive alternative, consider trading WTI contracts-for-difference (CFDs), discussed below.

Oil Contracts-for-Difference (CFDs)

The high volatility of the WTI crude oil market can be particularly attractive for traders looking to make large profits over a relatively short time period. Of course, there is also greater risk, as there may be significant losses as well.

Oil CFDs is a popular way for traders to access opportunities in the WTI oil market. A type of financial derivative, CFDs are contracts used to exchange the difference in WTI oil prices between the point when the contract is opened, and the point at which it is closed.

Essentially, Oil CFDs allow you to trade on the price movement of WTI crude over a time duration of your choosing. Should the price of oil move as you predicted, you can close the contract for a profit. If the oil price moves against you, you’ll close the contract at a loss.

Unlike oil futures, WTI oil CFDs are settled in cash, whether a profit or a loss is made. There is no need for you to take ownership of the underlying commodity, which eliminates the risk of physical storage.

How to trade WTI crude oil

Looking to trade WTI crude oil? Follow here’s a step-by-step guide to get you started.

Start WTI crude oil trading

1. Open a live account

Firstly, sign up for a Vantage trading account. You will need to open a Live account to trade WTI oil CFDs.

Follow the on-screen instructions to apply for your trading account. Once your account has been approved, you may fund your account in order to start trading.

2. Decide which WTI crude CFD you will trade.

Vantage offers two types of Brent crude CFDs, as follows:

- WTI Crude Oil Cash CFD. This allows you to trade on the spot price of WTI crude.

- Crude Oil Future CFD. This option lets you trade against the price movements of the oil futures market. Do be aware that oil futures are more complex and may be better suited to experienced or advanced traders.

3. Research and analyse the WTI crude oil market

Unless you have a time machine or a fortune-telling crystal ball, you cannot find lasting success trading the oil markets without a firm grasp of what’s going on.

Thus, it is essential to research and analyse the WTI crude market to learn its characteristics and how it responds to geopolitical events and market developments, in order to make informed bets when trading oil CFDs.

4. Build WTI crude trading strategies

As your knowledge of the WTI crude oil market grows, and you get a better grasp of your trading style and preferences, you should start building your own set of trading strategies.

This will help you identify opportunities and improve decision making when trading the high volatile WTI crude oil market.

Trade WTI crude oil using fundamental analysis

Fundamental analysis is a core discipline for any serious investor. It involves studying the relevant factors surrounding a security as a means of analysing it.

We’ve already discussed that for a commodity like WTI crude, some of the main drivers of price include global supply and demand levels, as well as geopolitical and macroeconomic factors. Thus, fundamental analysis for WTI crude entails keeping up with news reports, as well as analysts’ views and opinions about the important commodity.

Here’s a recent example of fundamental analysis in the context of WTI crude trading. In February 2024, following news that Israel had rejected a ceasefire offer from Hamas, prices of crude oil futures rose by around 3.2% [17]. The rejection had squashed hopes for a swift end to the armed conflict, further threatening oil supply.

While Israel only owns two oil refineries with an estimated production capacity of 300 barrels per day, the greater worry was that with prolonged conflict, more Middle Eastern countries may get drawn in and reduce export levels. This supply squeeze could cause crude oil prices to spike to new record highs, according to the World Bank [18].

Trade WTI crude oil using technical analysis

Technical analysis relies on data and indicators on a price chart to discern patterns, and gauge how likely a price trend may continue.

It allows traders to ignore market noise and focus on price action, which is believed to be the purest source of information on what’s going on in the WTI crude market. However, it’s important to note that while past prices may hint at future events, technical analysis in no way guarantees future outcomes.

Nonetheless, technical analysis is a useful tool for making trading decisions, including spotting potential entry and exit points.

Let’s take a look at how to perform technical analysis on WTI crude oil prices, using two popular indicators – 3EMA and RSI.

3EMA for WTI crude oil trading

The screenshot above shows a price chart of WTI crude oil spot prices, for a period spanning July 2023 to April 2024.

The red and green candlesticks make up the price chart. Superimposed over is the Triple Exponential Moving Average (3EMA), indicated by the green (20-day), yellow (50-day) and red (200-day) lines.

A moving average is a lagging indicator that shows the average prices based on a stipulated time period. Moving averages may be simple (all prices have equal weight) or exponential (the latest prices have more weight),

Specific to the screenshot above, we have three exponential moving averages (EMA), measuring the spot price of WTI the past 20 days, 50 days and 200 days.

When a shorter-duration EMA crosses under a longer-duration one, a bullish trend is indicated. The reserve is also true; when a shorter EMA crosses over a longer one, a bearish trend is indicated.

Between August to October 2023, the price of WTI was in a bullish trend. This is reflected in the 20-day EMA (green line), which remained high above the other two EMA lines.

Now, if you look at the right side of the chart, you’ll see another bullish trend forming, as indicated by the consecutive green candles. The green EMA line has stayed above the yellow EMA, and recently broken through the red EMA.

This hints that the WTI crude spot market may be entering a strong bull market, and the rally may last as long as the green EMA continues to diverge from the other two EMA lines.

RSI for WTI crude oil trading

The Relative Strength Index (RSI) is used to show when an asset or commodity is over- or under-traded. The index runs from 0 (minimum trading) to 100 (maximum trading), and usually has 30 and 70 as customary cut-off points.

This means that when the RSI is under 30, this indicates under-trading, and thus, the price at the time is likely to be reasonable. If the RSI is over 70, this indicates the asset is over-traded, and the price is likely to be too high as a result.

Here’s the screenshot of WTI crude oil prices again. The RSI is in the bottom-half of the screen. The Index proper is the purple line, and the yellow line is the RSI moving average which we will ignore for now. The purple shaded area represents the bounds between 30 (oversold) and 70 (overbought).

Earlier on, the 3EMA indicates that WTI spot prices are entering a bullish trend. When you look at the RSI in the right side of the screenshot the upwards slope of the purple line confirms the bullish sentiments of traders. The good news is the RSI has yet to enter overbought territory – meaning there is headroom for the price to grow, lending further support to the expectation that the bull rally will last for a period of time.

If, however, the RSI is already at overbought levels at the beginning of the rally, the bullish trend may be short-lived as traders may feel the price is too high and strive to make a quick exit.

Risk management when trading WTI crude oil

Crude oil is a highly volatile commodity with many wild price swings seen throughout history, and WTI is no exception. The market is also sensitive to macroeconomic forces and geopolitical events, making trying to predict how prices will react a complicated affair.

Hence, it is crucial to implement proper risk management measures when trading oil commodities. Investors should consider the following.

Proper trade sizing

An undisciplined trader may be easily swayed to make a larger bet in the hope of a larger payoff. This is highly risky and can lead to poor outcomes with WTI crude commodities. Instead, an appropriately sized trade should be adhered to each time.

As a general rule, each trade should risk no more than 1% to 2% of your capital, reducing as your account size grows [19].

Caution when using leverage

Oil CFDs are a popular way to trade WTI crude. CFDs may be traded on leverage, which not only allows you to start trading with smaller capital, but also amplifies your trading outcome – whether it be profit or loss.

This means that while leverage can help you make gains quickly, it can also make you exceed your starting capital (i.e., have a negative balance in your trading account).

Given its double-edged nature, it is important to use leverage with caution. It is advisable to only use leverage when you have built up enough experience and discipline to handle the potential consequences.

Setting stop-losses and take-profits levels

Traders should also consider two popular tools to help in risk management. These are stop-losses and take-profits, which are predetermined points on a price chart at which you will close your trade.

When used properly, stop-losses and take-profits help you limit your losses from a losing trade, or prevent having your gains wiped out by a reversal by closing a profitable trade in a timely manner.

WTI crude oil trading strategies

Earlier we mentioned that you should build your own set of trading strategies as you learn and hone your skills as a WTI oil trader. This is to help you instil discipline and focus in your trading.

Here are some common WTI crude oil trading strategies.

Day trading

Day trading is focused around making extremely short-term trades that can range from just a few minutes to several hours – or sometimes up to a day. Rarely do day traders hold WTI crude trades overnight.

The aim is to capture returns from Brent crude price action throughout the trading day, with the aim of making profits from very short-term price movements. Day traders often use leverage to amplify their results, but as discussed, doing so increases the risk of experiencing losses from trades.

Position trading

In contrast to day trading, a position trading strategy involves holding a position in the WTI crude market over a comparatively longer time frame. The goal is to make a profit when the market moves in a favourable direction.

Position traders may use both long and short positions to hedge against risk and to expand the range of trading opportunities in the crude oil market. This strategy is well-suited to a variety of WTI crude oil instruments, including oil stocks and ETFs.

Swing trading

Swing trading attempts to reap returns when the price swings from up to down or down to up over several days or weeks. This involves speculating on expected WTI crude price movements based on market sentiment, macroeconomic news or geopolitical events. Some swing traders also rely on technical analysis to identify an upcoming swing.

This trading strategy is slower paced than day trading, as traders have the option to keep their trades open for significantly longer durations – typically all the way until the swing runs its course.

Read our guide on “Position Trading vs Swing Trading” to help you understand each strategy better.

Trend following

Trend following or trend trading is a simple idea at its core: Trade with the trend, and not against it. This means choosing short or long positions in accordance with the overall price trend that is happening in the WTI crude oil market.

Success in trend following hinges on correctly identifying the current price trend, determining how long this trend is likely to last, and having the discipline to react accordingly when the trend has ended its run.

Trend traders are apt to use technical indicators on a price chart to gauge trend momentum and direction.

Sentiment trading

As per its name, sentiment trading is a trading strategy based upon market sentiment towards WTI crude oil prices. When the outlook is good, and prices are expected to rise, a sentiment trader may decide to open a long position to potentially capture profits. When the outlook turns negative, a sentiment trader may decide to use short-selling instead.

While sound in theory, the challenge stems from the volatile nature of the WTI crude oil market. Much experience is required to get a good grasp on the nature of the market, and how to filter out noise and focus on what truly matters.

News trading

News trading is similar to sentiment trading, in that trades are made as news events are announced. In particular, earnings reports by WTI crude oil companies, political announcements such as elections, and economic reports like inflation readings and employment levels are especially potent in a news trading strategy,

To be successful, a news trader must be able to evaluate relevant news reports and form the correct theories to support the trades they make.

WTI crude oil trading hours

The trading hours for WTI crude depends on where you choose to carry out your trading. If you’re trading WTI futures, you’ll need to adhere to the trading hours of the exchange on which they are offered, such as the NYMEX.

Meanwhile, if you choose to trade WTI crude using other instruments such as CFDs, stocks and ETFs, you will be able to make trades according to the online brokerage you choose.

WTI crude futures trading hours on Intercontinental Exchange Inc (ICE) [20]

| City | Trading hours | Pre-open |

| New York | 8pm to 6pm (next day) | 7.45pm |

| London | 1am to 11pm (next day) | 12.45am |

| Singapore | 9am to 7am (next day) | 8.45am |

Market open time for Monday morning/Sunday evening is 23:00 London (local time)

WTI crude CFDs

Vantage offers trading to WTI CFDs during the following time periods:

| Description | Symbol | Trading time (GMT+2) |

| WTI Crude Oil Cash | USOUSD | Monday – Friday:01:00-24:00 |

Key takeaways for WTI crude oil trading

WTI crude oil is the main benchmark for the US oil market, which has once more risen into prominence with the advent of hydraulic fracturing extraction methods. Thus, WTI offers an alternative to Brent, for those seeking to reap potential returns from the oil markets.

While geographically distinct from Brent, WTI is also impacted by many of the same factors, such as global economic slowdowns, or actions and decisions by OPEC. This explains why Brent and WTI prices seem to chart a similar path for the most part, but there are also instances when one rises against the other.

One key characteristic of WTI is its high volatility, with average prices ranging from USD 20 to USD 100 per barrel in just two short decades. This is due to the commodity’s sensitivity to geopolitical events, economic news and global developments.

WTI trading is primarily done using futures contracts, but this is a highly advanced trading method that may not be suitable for all investors. Another disadvantage to retail investors is that oil futures employ physical settlement – meaning the means to take delivery of barrels of crude oil is required.

To gain access to opportunities in the WTI crude oil market without having to deal with futures, consider oil stocks, energy ETFs and WTI CFDs as a more manageable option.

Trade WTI crude CFDs with tight spreads at Vantage

Vantage offer tight spreads starting from 0.0, allowing you to trade WTI crude via CFDs at minimum cost. Enjoy lower cost with no deposit fees, monthly rollover fees and other hidden fees.

Pick from desktop or online trading platforms MT4, MT5, or trade anywhere on the go with Vantage mobile app. All our platforms are packed with powerful features that allow you to react instantly to the latest oil market developments. Deploy long and short strategies to potentially capture gains no matter which way the market goes, and manage risk with our array of flexible tools.

Trade Brent crude via CFDs with Vantage and experience the difference. Sign up now and enjoy a deposit bonus* to boost your first trade!

*Terms & Conditions apply.

Frequently Asked Questions (FAQs)

Q1. What is the spread on WTI crude oil assets at Vantage?

We offer tight spreads for WTI CFDs, starting from as low as 0.0. Trade at minimum cost with Vantage.

Q2. What are the risks of WTI crude oil trading?

When trading WTI crude oil, one of the main risks is volatility. Being an essential commodity that underpins the world economy, the price of WTI is highly sensitive to various economic and political events.

Traders should be aware that wild price swings can happen when trading WTI, and should take appropriate risk management measures. They should also expect to invest substantial time and effort in studying the market, and keeping track of news, trends and developments that could impact the price of WTI crude oil.

Q3. What are the additional tips for trading WTI crude oil?

The complexity involved in crude oil extraction, production, distribution and storage can mean that producers are sometimes slow to react to changes in demand, contributing to high price volatility.

As such, it’s important for traders to be able to react swiftly so as to take advantage of potential opportunities. To this end, investors should consider choosing an online brokerage that offers fast, reliable connectivity and feature-rich trading platforms with an array of flexible and powerful tools.

Q4. Does Brent crude price affect WTI price?

With the United States now being a major global producer of crude oil, the price of WTI and Brent have been observed to share a correlation. Both indices often move in the same overall direction, as Brent and WTI are often affected by the same developments – such as a global economic recession.

However, differences in supply can cause the price trends of both to diverge. For instance, WTI is based on oil production taking place in landlocked regions of the United States; this is considered a more stable source of supply, and thus more resilient to troubling geopolitical events affecting other parts of the world. Brent, being a global benchmark, is more sensitive to a larger array of events.

Read our guide on the difference between Brent Crude and WTI Crude to help you understand how fluctuations in these prices can impact the global oil market.

Q5. Can I practise WTI crude oil trading?

Yes. Traders and investors wishing to practise WTI crude trading and test out trading strategies on paper may do so by signing up for a free Vantage demo account. There are no fees or minimum deposit required to practise WTI oil trading with a demo account.

References

- “West Texas Intermediate (WTI): Definition and Use as a Benchmark – Investopedia” https://www.investopedia.com/terms/w/wti.asp Accessed 5 April 2024

- “Energy Investing Basics: WTI vs. Brent Crude Oil – Charles Schwab” https://www.schwab.com/learn/story/energy-investing-basics-wti-vs-brent-crude-oil Accessed 8 April 2024

- “PERMIAN BASIN DATA STATS NEWS & INFO – Enverus” https://www.enverus.com/permian-basin/ Accessed 5 April 2024

- “History of O&G in the Permian Basin – Integrity Wireline” https://www.integritywireline.com/history-of-og-in-the-permian-basin/ Accessed 5 April 2024

- “How to Invest in Oil – Investopedia” https://www.investopedia.com/ask/answers/08/oil-as-investment.asp Accessed 5 April 2024

- “An oil futures contract expiring Tuesday went negative in bizarre move showing a demand collapse – CNBC” https://www.cnbc.com/2020/04/20/oil-markets-us-crude-futures-in-focus-as-coronavirus-dents-demand.html Accessed 5 April 2024

- “How Oil Prices Affect the Stock Market – Investopedia” https://www.investopedia.com/ask/answers/030415/how-does-price-oil-affect-stock-market.asp Accessed 5 April 2024

- “Long-term investment trends: the crude oil boom in the 2000s – LGT Private Banking” https://www.lgt.com/sg-en/market-assessments/insights/financial-markets/long-term-investment-trends-the-crude-oil-boom-in-the-2000s-91686 Accessed 5 April 2024

- “History of Oil Prices – Investopedia” https://www.investopedia.com/history-of-oil-prices-4842834 Accessed 5 April 2024

- “What triggered the oil price plunge of 2014-2016 and why it failed to deliver an economic impetus in eight charts – World Bank Blogs” https://blogs.worldbank.org/en/developmenttalk/what-triggered-oil-price-plunge-2014-2016-and-why-it-failed-deliver-economic-impetus-eight-charts Accessed 5 April 2024

- “What Happened to Oil Prices in 2020 – Investopedia” https://www.investopedia.com/articles/investing/100615/will-oil-prices-go-2017.asp Accessed 5 April 2024

- “Oil and Gas Executives Predict WTI Oil Price – Rigzone” https://www.rigzone.com/news/oil_and_gas_executives_predict_wti_oil_price-29-mar-2024-176242-article/ Accessed 5 April 2024

- “Making History: Coronavirus and Negative Oil Prices – Global Risk Insights” https://globalriskinsights.com/2020/05/making-history-coronavirus-and-negative-oil-prices/ Accessed 8 April 2024

- “Top Factors That Affect the Price of Oil – Investopedia” https://www.investopedia.com/articles/investing/072515/top-factors-reports-affect-price-oil.asp Accessed 5 April 2024

- “How does the war in Ukraine affect oil prices? – World Economic Forum” https://www.weforum.org/agenda/2022/03/how-does-the-war-in-ukraine-affect-oil-prices/ Accessed 5 April 2024

- “Oil ETF: What It is, How it Works, and Challenges – Investopedia” https://www.investopedia.com/terms/o/oil-etf.asp Accessed 5 April 2024

- “Oil up 3% on Gaza ceasefire rejection and US fuel stocks data – Reuters” https://www.reuters.com/markets/commodities/oil-edges-up-with-slim-progress-gaza-peace-talks-2024-02-08/ Accessed 5 April 2024

- “Oil price could reach $150 a barrel in 2024, warns World Bank – Offshore Technology” https://www.offshore-technology.com/news/world-bank-say-oil-price-could-reach-150-next-year/ Accessed 5 April 2024

- “Risk Management Techniques for Active Traders – Investopedia” https://www.investopedia.com/articles/trading/09/risk-management.asp Accessed 5 April 2024

- “WTI Crude Futures – ICE” https://www.ice.com/products/213/WTI-Crude-Futures Accessed 5 April 2024