You have probably heard of the phrase “time is money”, and when it comes to the growing your funds, this couldn’t be truer!

The sooner we start growing our funds the more time they have to potentially multiply.

This simple yet powerful concept lies at the heart of sound financial planning, offering a pathway to potential long-term financial security.

In this article, we’ll be looking at 6 reasons why starting to grow your funds early isn’t just advisable – it’s essential for potentially achieving your financial goals and securing your financial future.

5 Reasons to start growing funds early

1. Gives your funds time to grow

Starting your investment journey early not only provides your money with the gift of time, it also allows it to harness the power of compounding interest.

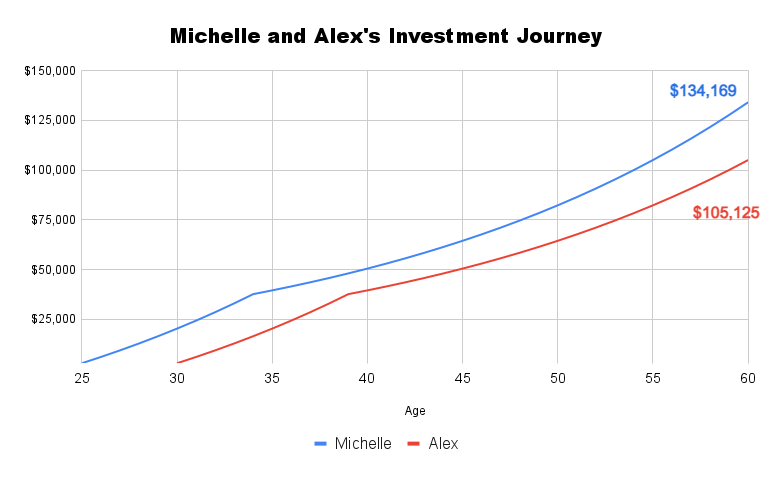

Let’s take a look at this scenario between two friends, Michelle and Alex. Michelle and Alex wish to invest and grow their funds for retirement.

If investments perform favourably, Michelle, who begins investing $3,000 annually at age 25, would have accumulated more than $15,000 than Alex by the time they both reach 40, despite Alex starting at age 30..

Now let’s talk about compounding interest.

In simple terms, compound interest is the interest earned on both the initial principal and the accumulated interest from previous periods, resulting in exponential growth of funds over time.

The best part about starting early is that you don’t have to put a lot of your savings into growing. Thanks to compound interest, your small amounts can appreciate significantly over time.

Let’s further illustrate compounding interest with Michelle and Alex.

Michelle invests $3,000 annually from the age of 25 for 10 years, totalling $30,000.

Alex, on the other hand invests the same amount of $3,000 each year for 10 years but at 30 years old.

Both earn an annual return of 5%.

In the figure above, we can see that at 60 years old, Michelle would have accumulated $134,169 while Alex would have accumulated $105,125.

Despite both earning an annual return of 5%, Michelle’s early start allows her investments to benefit from compounding interest over a longer duration.

2. Combatting inflation

By investing early and allowing your funds to grow, you have a better chance of keeping pace with, or even potentially outpacing inflation.

Over time, the value of money decreases due to inflation, meaning that the same amount of money buys fewer goods and services.

For example, an apple that costs $2 today might cost $2.50 next year, representing a 25% increase in price due to inflation.

Inflation is caused by factors like increased demand, rising production costs, monetary policy, and expectations of future price increases.

Here are the inflation rates for the different countries as of 26 April 2024 [1,2,3,4,5]:

| Country | Inflation Rate |

| United States | 3.5% |

| United Kingdom | 3.8% |

| Japan | 2.7% |

| India | 4.85% |

| Australia | 4.1% |

Saving money alone is not sufficient because if your savings do not keep pace with inflation, their real value diminishes over time. It’s like trying to fill a leaky bucket – without growth that outpaces inflation, your savings lose value in real terms.

By investing early and potentially earning returns that exceed the rate of inflation, you can combat its erosive effects and preserve or even increase your purchasing power.

3. Achieve Financial Independence Earlier

Early investments lay the groundwork for potential financial independence.

Financial independence signifies the ability to sustain your desired lifestyle without relying on traditional employment income. To achieve financial independence, you need to consider various factors, such as determining how much money you need to cover your expenses without working or to fund your retirement.

By starting to invest early and consistently increasing your investment contributions, you can potentially work towards building a substantial nest egg that supports your financial goals and future plans.

The longer your investments have time to grow, the greater the potential for wealth accumulation.

4. Investing with Lesser Financial Commitments

Investing at a younger age offers a unique advantage: fewer financial commitments.

Unlike later stages in life when responsibilities like mortgage payments, extensive insurance plans, and supporting dependents become more prominent, younger individuals generally have lesser financial obligations.

This translates to more disposable income and time for investing, providing a valuable opportunity to kick-start potential wealth accumulation.

Starting early also exposes you to a wealth of investment opportunities and learning experiences. Whether it’s exploring different trading strategies or understanding risk appetites, early investments provide invaluable lessons that shape your financial journey.

Begin your journey to financial literacy and potential investment success by enrolling in our free education courses.

5. Opportunities for learning and embracing risk

As mentioned in the point above, younger individuals typically have fewer financial commitments and are better positioned to take on more risk in their investment ventures.

This period serves as a valuable learning opportunity to understand various investment strategies, trading styles, and risk appetites.

By embracing risk early on, investors can develop a deeper understanding of the market and their own investment preferences, laying the groundwork for informed decision-making in the future.

This proactive approach to risk management not only fosters financial growth but also builds resilience and confidence in navigating the dynamic landscape of investments.

How Can I Grow My Funds?

Whether you’re saving for emergencies, dreaming of homeownership, or preparing for retirement, defining your goals provides a roadmap for your financial journey. By setting clear objectives, you can align your budgeting efforts and allocate funds strategically, ensuring you stay on track to achieve your aspirations and secure your financial future.

Here are some ways for you to potentially grow your finances:

1. Automate Your Investments

Set up automatic contributions to your investment accounts to ensure consistency and discipline in saving and investing. Automating your investments can help you stay on track towards your financial goals.

2. Contribute to Retirement Accounts

Take advantage of tax-advantaged retirement accounts available in your country. Maximise your contributions to these accounts to benefit from tax benefits and accelerate your retirement savings.

3. Invest in Blue-Chip Stocks

Consider allocating a portion of your investment portfolio to blue chip stocks.

Blue chip stocks are shares of well-established companies and typically have a track record of stable performance. This stability offers investors lower risk and volatility compared to other types of stocks.

Additionally, many blue-chip companies such as Apple, NVIDIA, Pepsi and Exxon, pay out regular dividends. These dividends can serve as a secondary, passive income stream for investors, enhancing the overall return on investment.

Capitalise on Brokerage Offers and Opportunities

When it comes to your investment journey, don’t overlook brokerage offers and opportunities. Brokerage firms often provide promotions and programs designed to help you maximise your returns.

These incentives can range from enticing cash bonuses to the convenience of commission-free trades.

Reference

- “Australia Inflation Rate – Trading Economics” https://tradingeconomics.com/australia/inflation-cpi Accessed 26 April 2024

- “Inflation Rate In India: April 2024 Data – Forbes Advisor” https://www.forbes.com/advisor/in/personal-finance/inflation-rate-in-india/ Accessed 26 April 2024

- “Japan Inflation Rate – Trading Economics” https://tradingeconomics.com/japan/inflation-cpi Accessed 26 April 2024

- “Current US Inflation Rates: 2000-2024 – US Inflation Calculator” https://www.usinflationcalculator.com/inflation/current-inflation-rates/ Accessed 26 April 2024

- “Inflation and price indices – Office for National Statistics” https://www.ons.gov.uk/economy/inflationandpriceindices Accessed 26 April 2024