Weekly Outlook | Markets in the shadow of poor economic data

Important events this week:

Last week was characterized by an increase in volatility. Important news events repeatedly triggered major short-term price swings. The Fed’s interest rate decision was particularly important. The Fed left interest rates at their current level, but opened the door very wide for a reduction in interest rates in September. The focus is now on economic rather than inflation data. The NFP labor market data on Friday came as a surprise with a weak figure: only 114,000 new jobs created instead of the 178,000 expected, causing the Dollar and equities to sell off sharply.

The oil market also lost steam. It is to be expected that oil consumption will also fall as economic activity declines. Last week’s movements could now have a further impact on markets.

There are only a few important publications this week. The extent to which geopolitical tensions will move markets remains to be seen. In addition, the trend of weak economic data and declining risk appetite could continue to weigh on markets. The increase in volatility as seen in the VIX (volatility index of the S&P 500) indicates that more pressure might be expected, especially on the equity market.

– AU- Interest rate decision – It is not expected that the interest rate in Australia will be adjusted. On an annualized basis, the consumer price index remains at 3.8%. This should continue to be a reason for the central bank not to touch rates for the time being.

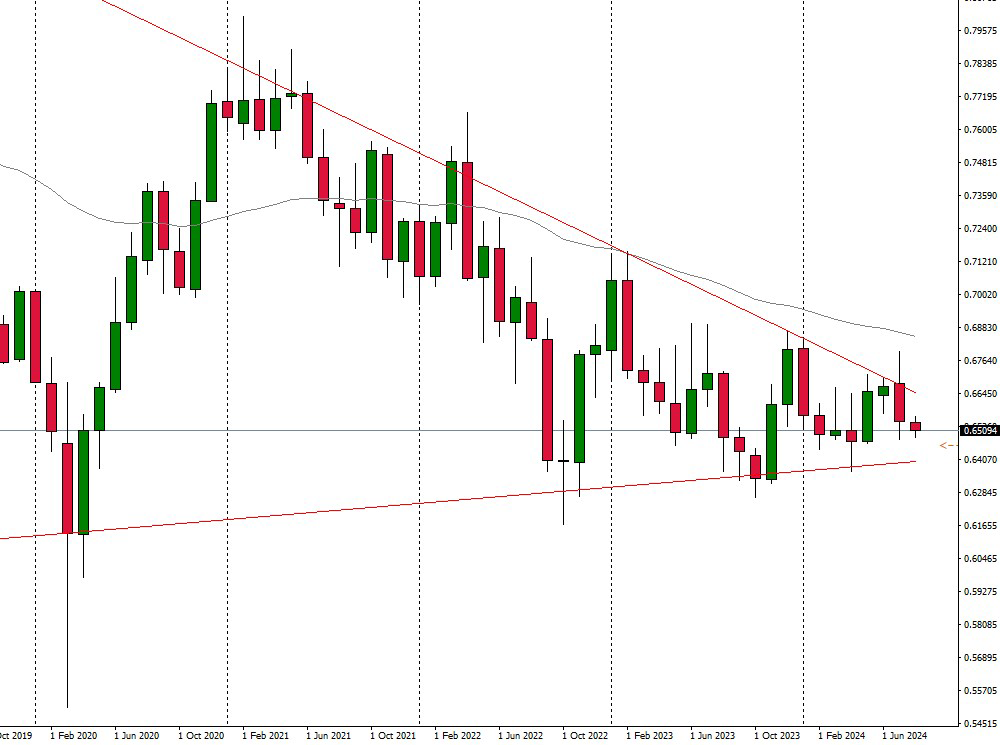

The Australian Dollar remains weak against most other currencies. Poor economic data from the US could lead to further losses. The Aussi is generally regarded as a “risk-on” currency, which is likely to fall as risk appetite declines. The monthly chart of the AUDUSD currency pair above shows this trend impressively. Further losses could therefore occur. The interest rate decision will take place on 06 August at 06:30 CET.

– CA Unemployment Rate – This month the labor market data release does not fall on the same day as the US NFP labor market data, as is usually the case. The Canadian Dollar remains very weak at the moment.

The current pressure on the oil market could be one reason why the CAD could continue to behave negatively, as it is under pressure across the board.

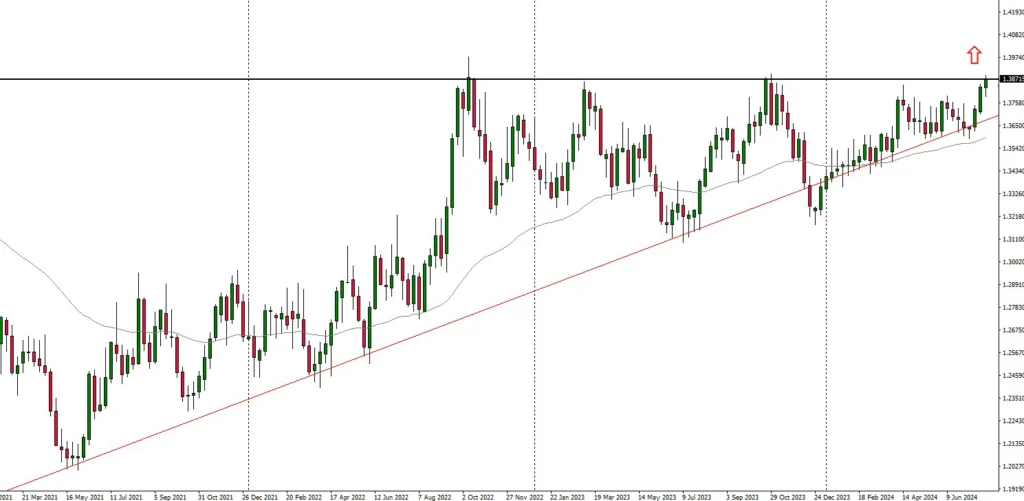

After the NFP data, the Loonie showed further weakness. This trend could now continue as key resistance levels have now been breached.

The long-term positive trend of the USDCAD pair impressively shows that the upward movement could continue. A breakout above 1.3875 on the monthly chart could then open up further potential. The unemployment rate will be published on Friday, 09 August at 14:30 CET.