Gold shines as stocks chop and USD is mildly bid

- US/Russia talks on Ukraine grab the limelight in relatively quiet trade

- G7 allies weigh tightening Russian oil cap to hurt Moscow

- Gold surges, while dollar ticks higher, as physical supply in London is under pressure

- S&P 500 and Nasdaq close at record highs ahead of Fed Meeting Minutes

FX: USD was bid after four days of selling. News flow was dominated by US and Russia ceasefire talks about Ukraine. The Fed’s Waller grabbed some headlines too, as he called for rates to be on hold, with the recent CPI data labelled as “disappointing”. The FOMC Minutes will be in focus from the “hawkish hold” meeting. The Fed is seen as on hold for an extended period, with sticky CPI and a solid labour market.

EUR fell with European leaders meeting in Paris for an emergency summit on Ukraine. Increased defence spending won’t help the euro due to more government borrowing, while common spending on the fiscal side to counter US tariffs is unlikely. Regaining 1.05 is key to more upside. Support is the 50-day SMA at 1.0393.

GBP consolidated with an inside day trading pattern. That means the whole day’s range was inside the prior day’s high/low. The latest jobs data was solid, even if the outlook is looking increasingly shaky. Redundancy levels are low with wages printing stronger than expected. CPI data is next up today. The 100-day SMA is at 1.2678. The 38.2% retracement of the 1.34/1.21 decline seen between September and January resides at 1.2609.

USD/JPY found a bid with prices finding support at the major retracement level (38.2%) of the September to January move at 151.50. The US 10-year Treasury yield picked up, bouncing off 4.50%. Trade and machinery orders data are released today in Japan.

AUD printed a doji candle as prices consolidated just below the recent top at 0.6373. As expected, the RBA cut rates by 25bps for the first time in four years, after holding rates at 4.35% since November 2023. But it was accompanied by hawkish remarks by Governor Bullock, both in the statement and in the press conference. She seemed to focus on pushing back against the dovish repricing in money markets, repeating that the focus remains on inflation risk. USD/CAD traded in a narrow range holding around its recent lows just below 1.42 after stronger than expected inflation data.

US stocks: The benchmark S&P 500 rose 0.34% to settle at 6,129. The tech-heavy Nasdaq finished up 0.23% at 22,164. The Dow eked out a gain of 0.02% to close at 44,556. Energy and materials led the gainers while communication services were the major laggard. That was weighed on heavily by Meta (-2.76%) abruptly ending its 20-day win streak. Intel soared 16% amid bullish headlines that Broadcom and TSMC are considering separate deals that could split the company.

Asian stocks: Futures are mixed. Stocks were also mixed again with a lack of a Wall Street lead due to the US holiday. The ASX 200 traded down as a hawkish cut from the RBA dented risk taking, with energy and financials underperforming. The Nikkei 225 rose but retraced most of its gains. The Hang Seng and Shanghai Comp were varied as Hong Kong outperformed on tech and auto strength, while US-China frictions upset the mainland.

Gold surged, up for a second straight day as it closed in on the record high from last week at $2942. Last Friday’s sell-off now just seems like a healthy pullback and bullish consolidation before a push to new peaks. Goldman Sachs upgraded their year-end gold target to $3,100, up from $2890. The London gold market is under pressure. Delivery delays from the Bank of England’s vaults have stretched from the usual 2 to 3 days to a staggering 4 to 8 weeks. Some gold watchers are saying this is a red flag that the world’s largest gold hub is struggling to meet demand.

Day Ahead – RBNZ, UK CPI

The RBNZ is virtually fully priced for another 50bps rate cut, taking the OCR to 3.75%. Signals for further easing is expected, though likely at a more gradual pace. The current terminal rate is seen at around 3%. Near-term inflation projections are predicted to rise due to higher commodity prices, but medium-term forecasts should stick close to 2%. Global trade policies are the key risk, and more caution will see the kiwi sell-off.

Headline UK CPI is expected at 2.8% from the prior 2.5% y/y and the core at 3.6% from 3.2% y/y. Focus will, as always, be on services inflation which is predicted to print at 5.2%, matching the MPC’s current estimate. Risks to this data include possible front-loading of price increases ahead of April when labour costs increase. The BoE is currently on a gradual path of policy easing with one 25bps cut likely every quarter. Softer figures could see more easing priced in and hit GBP.

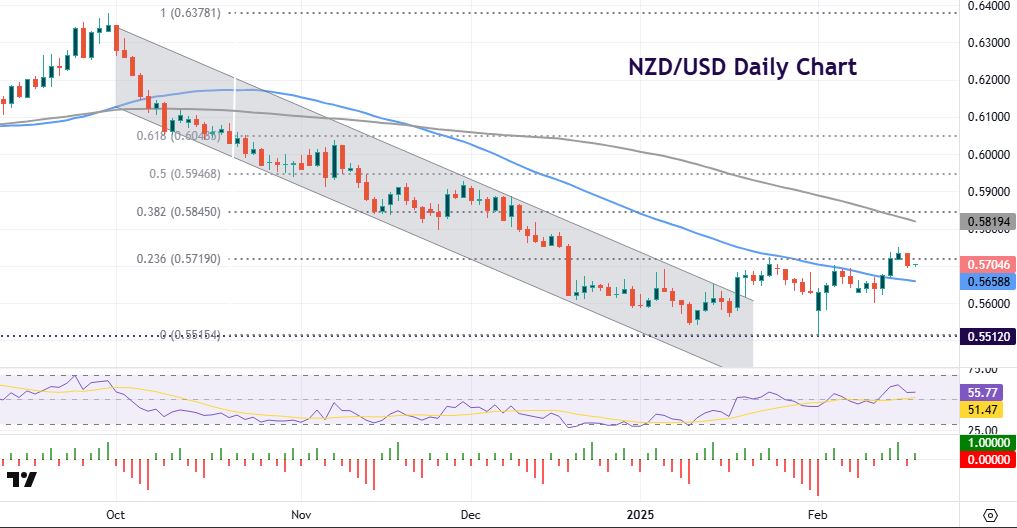

Chart of the Day – NZDUSD bounce stalls

A combination of weak growth, a loosening jobs market, and further disinflation also saw the deepest recession across the developed economies in 2024 in New Zealand. The unemployment rate has nearly reached its pandemic-era high. It seems the RBNZ faces minimal trade-offs to deliver further easing, even as the 125bp of easing so far has started to support near-term growth data.

This is a very similar chart to yesterday’s AUDUSD. The kiwi fell in a clean bear channel since topping out in September at 0.6378. A series of lower highs and lower lows pushed prices down to a low at 0.5540 in mid-January. Prices broke to the upside of the downward channel a week later but then printed a spike low at 0.5515 earlier this month. Crucially, this tallied with the long-term low from October 2022 at 0.5512 so is now a huge zone of support. Prices broke through the 50-day SMA at 0.5661 and have got to the first retracement level (23.6%) of the September to February drop at 0.5719. A hawkish RBNZ could see a topside break with bulls eyeing 0.5825, the 100-day SMA and 0.5845, the next Fib level.