Markets choppy with so much uncertainty and so many drivers

- Trump vows to slap 25% tariffs on EU, but lifts delay hopes for Canada & Mexico

- Zelensky says details of US deal for resources still need to be worked out

- US Dollar and equities are mixed as traders figure out way ahead

- Nvidia stocks wavers after earnings, after top line beats

FX: USD endured a choppy session as it gave up gains heading into the start of the US session before eventually settling in the green. Major question marks about the “Trump trade” linger, while there is much uncertainty around tariffs, DOGE, Ukraine, budget and data. A break of the recent low at 106.12 could see bears target 105.42. Yields also gave up gains with the 10-year eventually dropping to new lows for the move around 4.25%. Market pricing sees rates now as low as 3.5% by the end of next year.

EUR struggled again around 1.05. The minerals deal between Ukraine and the US has seen some speculation that a full US security guarantee could evolve. See more details below on the world’s most popular currency pair.

GBP broke to the upside as sterling outperformed before it gave up some of those gains. PM Starmer announced an increase in defence spending ahead of his trip to Washington and a Trump meeting. The next upside level is 1.2766 which is the halfway point of the September to January decline. The 200-day SMA sits just above at 1.2786. The 100-day SMA is at 1.2644.

USD/JPY got close to Tuesday’s y-t-d low in Asian hours before some choppy trading. We are watching 10-year Treasury yields as they correlate closely with this major.

AUD underperformed and fell for a fourth day in a row after printing a y-t-d high last Friday at 0.6408. Inflation printed inline with weighted CPI rising 2.5%. USD/CAD moved higher for a fourth consecutive day trading around the 50-day SMA at 1.4343. This pair is the bellwether for trade war volatility with next week’s 25% tariff deadline looming.

US stocks: The benchmark S&P 500 added 0.01% to settle at 5,956. The tech-dominated Nasdaq finished up 0.22% at 21,132. The Dow lost 0.43% to close at 43,433. Nvidia fourth-quarter revenue beat analyst’s estimates while first-quarter revenue forecast also exceeded expectations. But for the current quarter, the tech titan predicted non-GAAP gross margin of 71% less than estimates. That saw the stock trade marginally lower after the bell, having initially been in the green immediately after the earnings release. General Motors climbed 3.9% after news of a 25% increase in its quarterly dividend.

Asian stocks: Futures are mixed. Stocks traded mixed with a Chinese tech rally in contrast to the Nasdaq sell-off Stateside. The ASX 200 got hit as mining and consumer staples saw selling. The Nikkei 225 slid below 38,000 for the first time this year before buyers stepped in and the index closed very modestly lower. Recent yen strength reversed. The Hang Seng and Shanghai Comp advanced north with tech strength noticeable.

Gold printed an inside day after the strong sell-off on Tuesday. Support resides at $2881. The record high is $2956 with bullion currently on an eight-week win streak.

Day Ahead – ECB Meeting Minutes

The ECB cut its policy rate by 25bp in January with a unanimous decision – a fourth straight reduction – taking the key deposit rate to 2.75%. With minimal changes to its policy statement, the Governing Council noted that “disinflation process is well on track” and that the Governing Council “is not pre-committing to a particular rate path”. However, rate setters added that “wage growth is moderating as expected, with risks to growth still tilted to the downside. That was shown by GDP that came in at 0.1% in Q4 2024, though it still undershot ECB’s forecast of 0.2%.

The accounts of the meeting may provide further insights into the discussions which took place at the meeting and for policy going forward. ECB hawks have been noisy recently, with some suggesting that rates are no longer a material drag on growth. There have also been signals that policymakers could almost be done with easing. Of course, a lot has been happening since this January meeting, so the minutes may be seen as slightly stale.

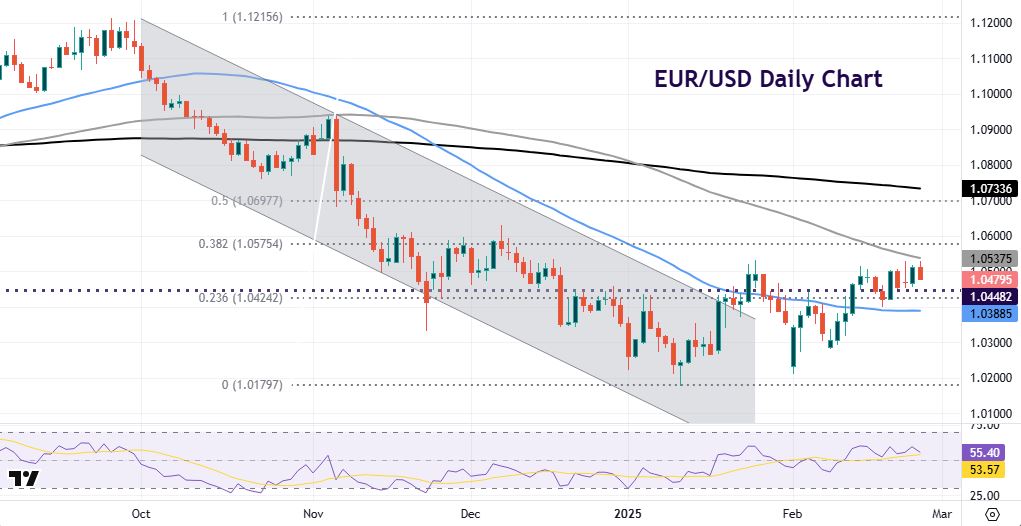

Chart of the Day – EUR/USD trying to break to the upside

There’s a new moniker in markets – MEGA – “Make Europe Great Again”. The recent shock from the US administration has potentially forced Europe’s leaders into action. This has seen German government bonds significantly underperform. That means yields have shot higher, with the yield curve “steepening”, in contrast to the US curve which has flattened. Defence spending is also set to ramp up while the Ukraine minerals deal could in time mean a US security guarantee. Meanwhile, the German election has pushed the new President and the current Bundestag to possibly rush through a softening of the German “debt brake” rules before it convenes on 25 March. Of course, the tariff threat remains a big uncertainty.

EUR/USD has been trying to decisively break to the upside through 1.05. But it failed again yesterday, even with MEGA being in fashion. The 100-day SMA sits at 1.0537. The major Fib level (38.2%) of the September to January decline is at 1.0575. Below is the minor retracement (23.6%) level at 1.0424, with the 50-day SMA at 1.0439.