Nvidia sparks tech sell-off as Trump tariff threat increases

- Trump’s Mexico and Canada tariffs to start March 4, additional 10% on China

- Dollar surges on ratcheting up of tariff talk, CAD, MXN, CNH all hit

- S&P 500 continues February sell-off as Nvidia tumbles

- Gold touched two-week low with firm dollar, inflation data in focus

FX: USD surged higher as tariff threats by Trump once again materialised in the run-up to the Canada and Mexico deadlines early next week. The US President also said China will likely be hit by an additional 10% tariff on March 4 as well. We expect more volatility into next Tuesday as trade war noise ramps up. There were also interesting comments from a Fed official who said he believes the Fed may be close to neutral right now – a very hawkish take on rates. Focus will be on today’s core PCE data. Dealers said month-end demand may be lifting the dollar.

EUR fell back down through the long-term pivot level at 1.0448 and below 1.04. Tariffs are the key fundamental driver at the moment with Trump also criticising VAT in Europe, while the Ukraine ceasefire deal is still to be resolved. President Zelensky is set to visit the White House in a high-stakes summit and potential signing of a rare minerals deal. Short-term rate differentials have moved in favour of the euro in February as fears over US exceptionalism have seen a dovish FOMC repricing.

GBP outperformed as PM Starmer visited Washington. Cable is trading around the 100-day SMA at 1.2639 and a major Fib level at 1.2609.

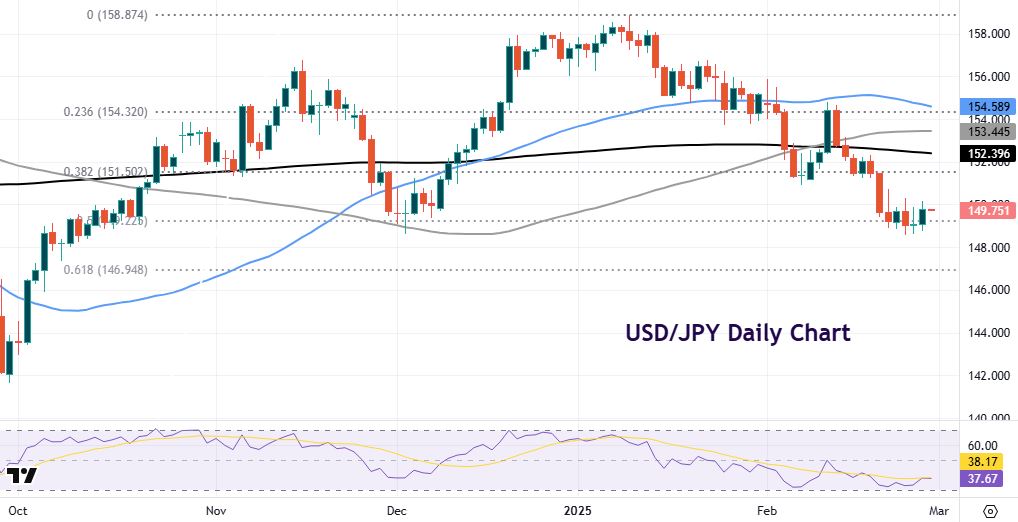

USD/JPY is consolidating after the move the halfway point of the fourth quarter rally at 149.22. Tokyo CPI is released, followed by US core PCE data. Japan’s Vice Finance Minister endorsed market expectations for tighter BoJ policy but noted that vigilance was required against speculative market moves.

AUD underperformed, with NZD, and fell for a fifth day in a row. Tariffs threats are not good for commodity, cyclical currencies! The 50-day SMA in AUD/USD resides at 0.6258. USD/CAD surged through the 50-day SMA at 1.4345. As we said yesterday, this pair is the bellwether for trade war volatility with next week’s 25% border tariff deadline firmly in Trump’s crosshairs.

US stocks: The benchmark S&P 500 lost 1.59% to settle at 5,861. The tech-laden Nasdaq finished down 2.75% at 20,550. The Dow lost 0.45% to close at 43,239. Tech was by far the biggest losing sector (-3.79%) with financials, energy, real estate consumer staples in the green. Nvidia got hit badly, closing down 8.6% on the day and losing $274bn off its market cap. Softer gross margin forecasts outweighed an upbeat revenue outlook. Other chipmakers also saw aggressive selling with Broadcom off 7% and AMD down 5%. The latest Trump remarks also hurt sentiment. The VIX, Wall Street’s fear gauge closed at its highest since December 19.

Asian stocks: Futures are in the red. APAC stocks followed the mixed performance on Wall Street after tariff threat volatility and Nvidia’s earnings.The ASX 200 edged mild gains amid outperformance in consumer staples after results from supermarket heavyweight Coles. The Nikkei 225 swung between gains and losses amid a quiet calendar and choppy yen. The Hang Seng and Shanghai Composite were initially pressured as trade frictions remain in the spotlight with US Commerce Secretary Lutnick recently commenting that China is his biggest concern.

Gold tumbled again on more profit taking, after Tuesday’s strong sell-off. The record high is $2956 with bullion currently on an eight-week win streak. Initial support sits at $2,857.

Day Ahead – Tokyo CPI, US Core PCE

Tokyo inflation data is seen as a forerunner to the nationwide figures. The headline is expected to soften modestly. But the core number ex-food and energy is forecast to rise back up to 2%. Hotter data is likely to push markets to price in earlier BoJ rate hikes. Currently, the chances of a May 25bp move higher are priced at just 20%. We note that speculative short yen positioning has flipped dramatically into stretched long yen positions in recent weeks.

The Fed’s favoured inflation gauge, the core PCE deflator, is seen rising one-tenth to 0.3% m/m and two-tenths to 2.8% y/y. Headline PCE is forecast at 0.3% m/m and 2.5% y/y. The Fed is waiting for further evidence that inflation is coming down before any policy action. That very likely means it is in prolonged policy pause mode. The sharp move in Treasuries recently has seen the terminal rates for Fed funds move to around 3.5%. Rates are currently at 4.25-4.50%.

Chart of the Day – USD/JPY hits major support

The major has fallen in a neatish bear channel since topping out at 158.87 in January. Prices pierced through both the 100-day and 200-day SMAs – now at 153.44 and 152.43. A clear break down through a major fib level (38.2%) of the September to January rally at 151.50 has seen sellers hit the next big retracement level (50%) at 149.22. Buyers have stepped in here and prices have consolidated around here, which is also the late November/ early December lows. The next Fib level (61.8%) is 146.94 with resistance now at 151.50.