Dollar dumped, euro ecstatic on fiscal bazooka

- German parties agree historic debt overhaul to revamp military and economy

- Euro surges again on zone and German debt brake reform

- ECB expected to cut rates amid nascent trade war and flagging growth

- Stocks find a bid as tariffs delayed and expected to be rolled back

FX: USD tanked again, dropping through support at 105.16 and the 200-day SMA at 105.00. That’s now more than a 3% decline in three days. US Commerce Secretary Lutnick initially suggested Trump could potentially reduce tariffs on Canada and Mexico. After a call with the CEOs of Ford, GM and Stellantis, Trump delayed auto tariffs by 30 days. The White House also noted it is open to hearing about additional tariff exemptions. ADP came in very soft while ISM Services data beat estimate, but markets barely blinked. There are currently around 70bps of rate cuts priced into the US curve for this year, with 26bps in the June FOMC meeting.

EUR enjoyed another big rally, jumping 1.53% on the day. Rate differentials continued to narrow as German government bonds collapsed. In fact, it was the biggest drop in the 10-year since the 1990s. That meant yields skyrocketed as ramped up spending should result in higher government borrowing and so those higher domestic yields. The debt brake reform and a Ukraine mineral deal both added to euro strength. See below for more on the major and the ECB meeting later today. European stocks jumped on the German fiscal bazooka.

GBP is riding on the back of super strong European FX. Cable surged through the 200-day SMA at 1.2786 and through a Fib level at 1.2766. The next Fib level of the September/January drop is 1.2924.

USD/JPY is consolidating near its recent lows below 150. Resistance above sits at 151.30 and near-term support is 148.08. Below here is a major retracement level of the September/January rally at 146.94.

AUD climbed higher for a third straight day as risk sentiment improved. The 100-day SMA looms above at 0.6381. USD/CAD fell for a second straight day – extraordinary in many ways after tariffs were announced. But obviously the delay in auto tariffs helped the mood.

US stocks: The benchmark S&P 500 gained 1.12% to settle at 5,842. The tech-heavy Nasdaq finished up 0.36% at 20,628. The Dow added 1.14% to close at 43,006. Only two sectors were in the red, Energy and Utilities as Brent crude dropped below $70 and major long-term support. The weekly close will be key. Materials led the gainers as prices firmed up through the session. Nvidia tried to hold onto support around $114 and Telsa is trading around its 200-day SMA at $280. The S&P 500 is back in positive territory since the November US election and year-to-date, up just over 1% and 0.66% respectively. That compares with the DAX year-to-date performance of +15.85%.

Asian stocks: Futures are mixed. APAC stocks were broadly in the green after tariff news and a subsequent possible rollback. The ASX 200 closed on its 200-day SMA with muted price action as energy and consumer sectors struggled. Better than expected GSP didn’t help the bulls. The Nikkei 225 closed above 37,000 but was choppy. The Hang Seng and Shanghai Composite were bid on the 5% growth target being maintained. CK Hutchinson surged by more than 20% after agreeing to sell its Panama Canal Ports stake to BlackRock.

Gold consolidated its two days of buying, printing a doji candle. That denotes a little bit of indecision between buyers and sellers. The record high sits at $2,956. The beleaguered dollar and subdued yields have helped gold bugs.

Day Ahead – ECB Meeting

Markets fully expect another 25bps ECB rate cut, which lowers the depo rate to 2.5%. This will be the sixth such cut since the 4% peak. Policymakers are fairly confident inflation will return to target over 2025, while growth concerns linger, especially with likely upcoming tariffs. The recent Q4 revision saw it print at 0.1% versus 0.4% in Q3. The most recent PMI composite came in at 50.2, just about in expansionary territory. Lower growth and higher near-term inflation are predicted in the new quarterly staff economic forecasts.

The hawks have been quite vocal recently about how much or if any more policy easing is actually needed going forward. That means the discussion around the terminal rate will be interesting. We will be watching the statement for any tweaks to “restrictiveness” language about rates. “No longer restrictive” could set the stage for a pause at one of the next meetings. Markets price in around a 60% chance of another cut in April, with the next fully priced one in June and a total of around 82bps by year end.

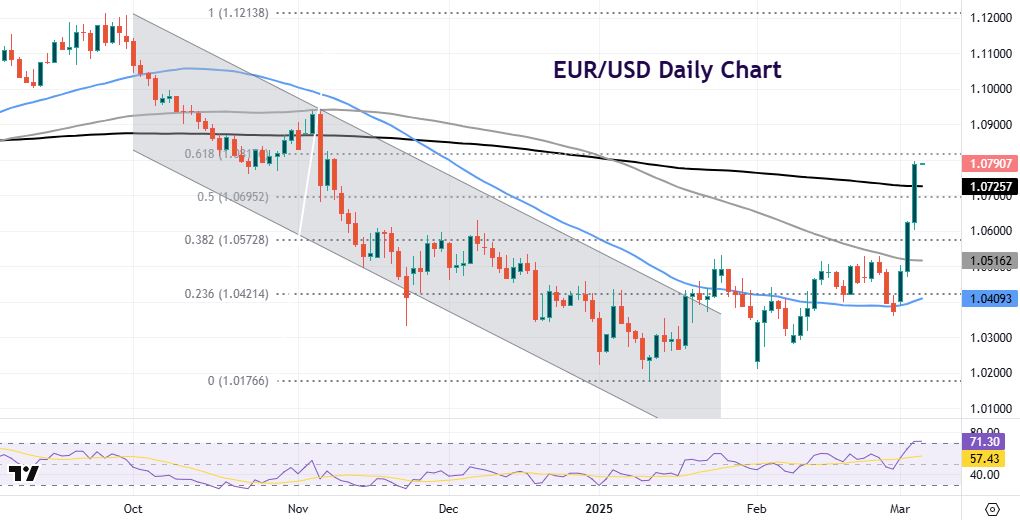

Chart of the Day – Euro rallies hard

Changes to the ECB statement will be key as per above. How much emphasis does President Lagarde put on there being “no pre-determined path” for policy? She could say that pauses have never been ruled out, for example. That could be the compromise with the hawks for keeping “restrictive” in the statement. It will be a shock if there is any forward guidance from Lagarde.

Of course, EUR has soared this week on the huge German and European fiscal plan around defence spending and infrastructure. A mineral deal and possible cease fire in Ukraine is back on the cards too. The world’s most popular currency pair has broken the midpoint of the September to January decline at 1.0572. The 200-day SMA has also been pierced at 1.0726. Next resistance is a major Fib level (61.8%) of that autumn drop at 1.0817. Prices are nearing overbought levels, so to the narrowing of rate differentials between EZ/US government bonds.