Gold is a precious metal that has had a long and stable history in financial markets. It is best known for being a store of value in time of stress, acting as a premium safe haven asset. Investors have always liked the certainty of holding the metal in their portfolios as it cushions them from unforeseen shocks.

Gold has also been known to act as an inflation hedge against surging price pressures and is inversely correlated to the dollar and real interest rates. The precious commodity rose to a record high last year amid geopolitical conflicts and economic uncertainty.

Key Points

- Gold symbolises prosperity and good fortune in Lunar New Year celebrations, often given as gifts to signify blessings for the new year.

- Gold prices often experience pre-Lunar New Year fluctuations, with a notable increase in Shanghai’s gold premiums due to heightened retail demand and a ‘Chinese New Year’ effect on the market.

- The near-term gold price forecast before Lunar New Year 2024 is influenced by US monetary policy, with potential impacts from the upcoming Federal Open Market Committee (FOMC) meeting, economic data releases, and geopolitical tensions.

Gold and its relationship to Lunar New Year

Gold has a major cultural significance in relation to the Lunar New Year. The precious metal symbolises prosperity, wealth, and good fortune in many Asian cultures, especially during the new year celebrations. Traditionally, gold jewellery and gifts are considered auspicious and bring blessings and positive energy for the coming year.

During this festive, holiday period, gift-giving is central, and gold items like jewellery, coins, and bars are popular choices. It is also a tradition for the older generation to give their children and grandchildren gold as gifts as this represents the passing down of prosperity through the generations. The surge in demand can temporarily drive up gold prices, particularly in major gold consuming nations like China and India.

Gold performance in 2023

Gold prices held up well last year and rallied in the last quarter hitting an all-time high in early December. An increase in bets that the US Federal Reserve would cut interest rates in the new year, allied to a fall in the dollar boosted prices. Safe haven demand due to investor concerns over the Israel / Hamas conflict and the ongoing Ukraine conflict also helped buoy gold bugs.

This vied with both the rising interest rate environment and a volatile dollar through 2023. Real yields – that is, nominal yields which account for inflation – initially climbed sharply in the first half of 2023 from a very low base, making zero-yielding gold less attractive. But the final few months of 2023 saw sharply lower bond yields as markets priced in a pivot by major central banks.

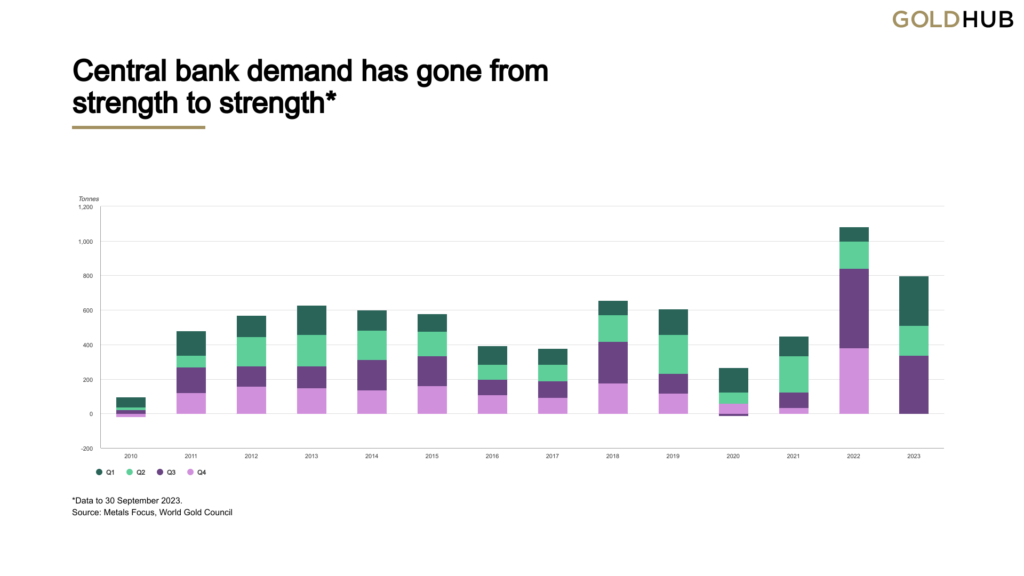

Significant ETF outflows in the investment community were evident throughout the year, but that weaker demand was more than offset by strong central bank buying. A record amount of the precious metal was bought in the first three quarters of 2023 as geopolitical concerns pushed central banks to increase their allocation towards safe assets. It is well known that the precious metal tends to become more attractive in times of instability and uncertainty.

As investors navigate the fluctuating landscape of gold prices, particularly around significant events like the Lunar New Year, contracts for difference (CFDs) on gold offer a dynamic tool for traders to utilise. These financial derivatives allow traders to speculate on the rise or fall of gold prices without actually owning the underlying asset. However, it’s crucial for traders to consider the inherent risks of leverage in CFDs trading, alongside the potential benefits.

Historical Trends of Gold Prices – Pre-Lunar New Year Fluctuations

The Lunar New Year is a jolly occasion which brings together family and friends who return to their ancestral homes. The holiday period usually falls between late January and late February; the exact date changes from year to year as it depends on the lunar calendar. This often means that there is a surge in gold retail buying ahead of the festivities. Of course, other wider macro factors will play a big part in driving the price of gold in general, including bond yields, the dollar and the current risk environment and outlook.

Regarding pre-Lunar New Year volatility, research by the CME Group shows that the period leading up to the Chinese New Year is often characterised by a disconnect between Shanghai and global gold prices. The premium for Shanghai gold prices tends to increase in the run up to Chinese New Year with this effect especially strong in 2010, 2013 and 2016. The World Gold Council estimated that on average, the local gold premium during six weeks prior to the new year has been 65% higher than the annual mean over a recent ten-year period[1].

Indeed, analysts describe it as a “Chinese New Year” effect as the three months with the highest average premium sits just before and during the holiday period i.e. December, January, and February. The average premium across this period is equal to over $5 per ounce.

Intrigued with the overview of gold prices? Dive deeper into our comprehensive 10-year coverage and trend analysis of gold prices to broaden your macroeconomic understanding.

Factors that might affect gold prices around the Lunar New Year

- Pre-Holiday Stocking-Up: Prior to the Lunar New Year, gold retailers experience increased footfall and sales as people stock up on gifts and festive decorations. In China, consumer’s’ purchasing power is also historically the highest around this time as it is driven by year-end bonuses.

Hundreds of millions of workers return home during this time and endeavour to bring gold as a good luck present and blessing after a year’s work. This pre-holiday buying, centred historically around December, can contribute to price rises. - Short-term Fluctuations: The increased demand around Lunar New Year doesn’t guarantee a sustained price increase. The cost of gold can rise as demand increases into the festive period, Certainly, the local gold price premium increases as the new year approaches. However, after the new year, prices may stabilise or even drop, depending on global market trends and other economic factors.

- Regional Impact: While the link between Lunar New Year and gold prices is most pronounced in China, it can also affect other Asian markets with significant gold demand. India’s love for gold goes back a thousand years, with celebrations, festivals and weddings often celebrated with jewellery-related gifts. Gold also has social significance in Indonesia, which has the world’s biggest gold deposit.

- Long-Term Trends: While Lunar New Year can provide a temporary boost, the overall direction of gold prices is determined by broader economic factors like inflation, global financial stability, and central bank policies. Gold often trades on the interplay between interest rates and yields, with the price of the dollar also impacting the metal.

Gold price forecast gold price before the Lunar New Year 2024

US monetary policy driven by the Fed will remain key to the near-term outlook for gold prices into the Lunar New Year in February. The first FOMC meeting of 2024 takes place on the last day of January with markets currently pricing in a high chance of the first rate cut at its March meeting. But recent important data like US CPI and non-farm payrolls have printed hotter than expected.

The next US employment report for January is released two days after that Fed meeting. A rebound in yields would push rates higher and these are typically negative for gold, which doesn’t offer any interest, and could see a stronger dollar. Regarding the greenback, gold and the buck tend to move in opposite directions as a falling dollar makes gold cheaper in other currencies and draws in net buyers – especially those who believe the abundant US monetary stimulus undermines the USD.

That said, both gold and the dollar can serve as a safe haven. This means the risk of geopolitical tensions escalating in the Middle East could be an important driver of gold prices in the next few weeks. Seasonal patterns for the dollar are also historically strong around this time of year.

For traders, these macroeconomic indicators and policy decisions present potential opportunities to trade. As expectations build around the Fed’s actions, particularly with the anticipation of interest rate changes, traders may position themselves for the market movements using gold CFDs and adjusting their positions to either long or short, based on their analysis of how these factors will impact gold prices.

To provide a clearer perspective, below is a chart illustrating the trends in Gold/XAU CFD price movement throughout 2023. This visual representation offers valuable insights into past market behaviours and can be a useful tool for traders planning their trading strategies for the upcoming Lunar New Year.

Ready to start trading gold CFDs? Open a live account with Vantage and gain access to our cutting-edge trading platform and resources to trade.

Conclusion

Celebrating new year is the most important festival for millions of people in Asia and has a significant meaning not only for family and friends but also for gold demand and prices. Buying something gold is considered to bring good fortune, wealth, and prosperity for the year head, while year-end bonuses also often mean that more money in pockets leads to higher gold consumption.

This year should typically see local gold prices increase into and during the festivities, with premiums potentially dipping after the holiday period. Wider market themes will also impact the precious metal amid global economic uncertainty. These themes include presently evident geopolitical tensions in the Middle East. Investors also need to determine whether markets have priced in too aggressive interest rate cuts and lower bond yields.

References

- “Chinese New Year: what does it mean for China’s physical gold market? – World Gold Council”. https://www.gold.org/goldhub/gold-focus/2020/01/chinese-new-year-and-china-physical-gold-market. Accessed 17 Jan 2024.