The year 2023 has been marked by significant events (particularly geopolitical ones) influencing the global markets. From major political shifts and company takeovers to the dramatic changes in the digital landscape and emerging conflicts, this year has reshaped the economic terrain.

This article will offer you, as traders and readers, a comprehensive overview of the pivotal moments that shaped 2023 as you reflect back on the year.

Advancements in Artificial Intelligence

The year 2023 marked a pivotal moment in the evolution of artificial intelligence (AI), with its impact resonating across various industries. This unprecedented surge in AI innovation opened a Pandora’s box of questions, challenging our notions of the future of work and the ever-evolving dynamics of labour markets.

Central to this year’s technological milestones was the launch of OpenAI’s ChatGPT-4 on 13 March [1]. This state-of-the-art language model, notable for its image response capabilities and ability to process up to 25,000 words, set a new standard in AI’s relentless advancement. Microsoft, a major investor in OpenAI, saw a significant increase in its stock value following the release of ChatGPT-4, with its shares climbing from $253.92on 13 March to a closing high of $279.43 by the end of the week on 17 March, underscoring the market’s sentiment about this technological leap [2].

Explore the ‘Future of AI‘ through The Vantage View, an informative collaboration with Bloomberg Media Studios, offering expert insights into AI’s evolving role in the trading industry.

Meanwhile, the tech industry faced its own set of challenges, particularly with the ongoing semiconductor shortage. This deficit of critical components continued to affect global production and supply chains, leading to increased costs and substantial disruptions. Nvidia, a key supplier of AI chips, emerged as a beneficiary of these market conditions.

The company’s financial results for the third quarter indicated that their revenue reached $18.12 billion, marking a threefold increase from the previous year and exceeding the consensus estimate of $16.18 billion [3]. A significant contributor to this success was the company’s data centre business, which includes AI chip sales.

This segment alone generated $14.5 billion in revenue for the last quarter, a 279% increase from the same period in the previous year [4]. Nvidia’s shares reflected this growth, starting at $143.15 on 3 January 2023, and reaching an all-time high of $504.09 on 20 November 2023 [5].

This semiconductor shortage situation highlights the ongoing challenges in stabilising the global supply chain, which continued to face disruptions following the pandemic in 2019. The struggle to balance technological advances with these persistent logistical hurdles became a theme of 2023.

Banking Crisis

For the financial sector, 2023 was a turbulent year as it was marked by a series of banking crises that impacted the global economic landscape. On 10 March, the unexpected collapse of Silicon Valley Bank (SVB) sent shockwaves through the financial system. This raised concerns about the US banking system as another bank, Signature Bank, was shut down on 12 March, after customers began withdrawing large sums of money in the wake of the collapse of SVB.

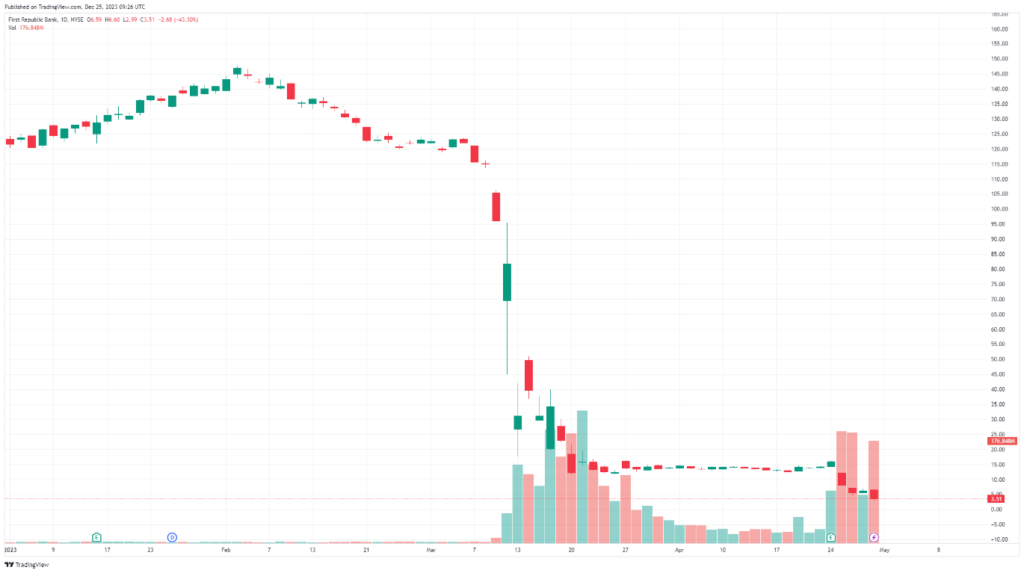

This event had a ripple effect; shares of First Republic Bank plummeted as investors sought to reduce exposure to institutions similar to SVB. The downward trend persisted, with the company’s shares continuing to drop nearly 50% to a record low of $12.18 on 20 March [6]. In April 2023, First Republic reported a 40% drop in deposits for the first quarter’s financial reporting, leading to a further decline in its stock price to $8.10 and extending its year-to-date losses to over 90% [7].

As of 1 May 2023, the Federal Deposit Insurance Corporation (FDIC) had concluded the closure of First Republic, transferring the majority of its deposits and assets to JPMorgan Chase. The stock was delisted on 2 May from the New York Stock Exchange (NYSE) following the acquisition [8].

Internationally, the US banking crisis also extended to Switzerland, where Credit Suisse experienced a collapse and was acquired by its competitor, the Union Bank of Switzerland (UBS), on 19 March. This event not only shook global financial markets but also raised concerns about employment stability within the banking sector, as such consolidations often lead to job redundancies and restructurings.

OPEC Production Cuts

The global oil market experienced substantial shifts due to strategic production cuts by the Organisation of the Petroleum Exporting Countries (OPEC) and its allies. These measures, primarily aimed at stabilising the market, had a significant impact on global oil prices.

Throughout 2023, OPEC made several pivotal decisions to manage oil production. Here’s a timeline of the oil cuts:

- January: OPEC upholds the 2 million barrels per day (bpd) production cuts agreed in October 2022.

- April: Saudi Arabia, along with other OPEC+ oil producers, declared additional oil production reductions amounting to approximately 1.16 million bpd, a move that resulted in an 8% increase in crude oil prices, pushing them up to $84.93 per barrel [9].

- June: OPEC+ agreed to prolong oil output reductions of 3.66 million bpd, equivalent to roughly 5% of daily global demand, until the end of 2024.

- November: OPEC+ plans to intensify voluntary cuts by 2.2 million bpd from January 2024, including:

- Continued Saudi and Russian cuts of 1.3 million bpd

- Voluntary reductions of 900,000 bpd by members like UAE (163,000 bpd), Iraq (223,000 bpd), Kuwait (135,000 bpd), Kazakhstan (82,000 bpd), Algeria (51,000 bpd) and Oman (42,000 bpd).

These production adjustments by OPEC had profound effects beyond the oil market, significantly influencing global economic conditions. The spike in oil prices, driven by these cuts, led to increased inflationary pressures, impacting energy costs for businesses and consumers. This raised global concerns about a potential recession, underlining OPEC’s pivotal role in the global energy market and its influence on economic stability.

In tandem with these developments, the year saw two major spikes in oil prices, each linked to a different benchmark. Brent crude oil peaked at $93.89 per barrel on 14 September, influenced by the prolonged output cuts from major producers such as Saudi Arabia and Russia [10].

Concurrently, West Texas Intermediate (WTI) crude oil reached a high of $94.00 per barrel on 27 September, fuelled by a significant reduction in US crude stocks [11]. These price peaks further emphasised the impact of OPEC’s strategic production decisions on the dynamics of the oil market.

Gain comprehensive knowledge with our oil trading guide, providing an in-depth understanding of the oil industry.

US Federal Reserve Interest Rate Hikes

The Federal Reserve’s aggressive interest rate hikes throughout 2023 aimed to combat inflation had a significant impact on financial markets. Rising interest rates led to bond yields increasing, impacting fixed-income investments and making borrowing more expensive. This contributed to a decline in the stock market, particularly for growth stocks and technology companies.

Here are the major US rate hikes that occurred in 2023:

- February: +0.25%

- March: +0.25%

- May: +0.25%

- July: +0.25%

At the latest Federal Open Market Committee (FOMC) meeting in December 2023, the Federal Reserve announced no further rate hikes for the remainder of the year, a decision that ultimately brought the federal funds target rate to a range of 5.25%-5.50% by the end of 2023.

The Federal Reserve has also indicated the possibility of reducing rates up to three times in 2024, contingent on inflation approaching the 2% target and a slowdown in economic growth. Nonetheless, Fed Chair Jerome Powell emphasised that future decisions in the upcoming meetings will be data-dependent.

Israel–Hamas Conflict

On 7 October 2023, Hamas initiated an unexpected operation on Israel. The group’s militants infiltrated areas close to the Gaza Strip, prompting Israel to respond with a forceful counter-offensive targeting the Gaza Strip. This escalation in hostilities has taken the international community by surprise and occurred amidst heightened tensions between Israelis and Palestinians.

The market reacted to the recent news similarly to how it does to geopolitical events (like Ukraine-Russia Conflict). The unforeseen geopolitical event increased perceived uncertainties, prompting a shift towards safe-haven assets. Initially, gold prices were struggling at the start of October, dipping under $1850 per ounce. However, by 27 October, gold rebounded strongly, surpassing the $2,000 per ounce mark [12].

Discover the decade-long journey of gold prices and trends in our insightful article: Gold Price Over 10 Years and Gold Trend Analysis. Additionally, traders can seize the market opportunities by opening a live account with Vantage to begin trading Gold CFDs.

Consequently, there was an upswing in the value of US Treasury bonds, and traditionally stable currencies such as the Japanese yen, US dollar, and Swiss Franc. Additionally, oil prices went up, though stock markets initially faced a decline. On 9 October, WTI crude oil futures grew by 4.3%, closing at $86.38, while International Brent futures climbed 4.2%, reaching $88.15 [13]. This marked the most significant single-day gains for WTI and Brent since 3 April.

Conclusion

The year 2023 has been a defining period for global markets, marked by significant events that have reshaped the economic landscape. Technological advancements in artificial intelligence have transformed industries and labour dynamics, while the banking crises have shaken the financial sector.

Moreover, OPEC’s strategic production cuts, the Federal Reserve’s interest rate hikes, and geopolitical developments like the Israel-Hamas conflict have all played pivotal roles in influencing market trends and investor behaviour. These events collectively highlight the complex and interconnected nature of global economic systems, underscoring the need for adaptive strategies and continuous monitoring in the face of evolving challenges and opportunities.

Learn more about the upcoming 2024 market outlook with our comprehensive article, helping you stay ahead and keep well informed for the year ahead. Follow us on Facebook and Instagram for a visual recap of the pivotal moments from 2023.

Reference

- “GPT-4 Released: What It Means For The Future Of Your Business – Forbes” https://www.forbes.com/sites/forbesbusinesscouncil/2023/03/28/gpt-4-released-what-it-means-for-the-future-of-your-business/?sh=5c1f5c6e2dc6 Accessed 18 Dec 2023

- “Microsoft Corporation (MSFT) – Yahoo! Finance” https://finance.yahoo.com/quote/MSFT/history?period1=1646092800&period2=1680220800&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true Accessed 18 Dec 2023

- “Nvidia’s revenue triples as AI chip boom continues – CNBC” https://www.cnbc.com/2023/11/21/nvidia-nvda-q3-earnings-report-2024.html Accessed 18 Dec 2023

- “1 Monster Opportunity in the Global Chip Shortage – The Motley Fool” https://www.fool.com/investing/2023/11/30/1-monster-opportunity-in-the-global-chip-shortage Accessed 18 Dec 2023

- “NVIDIA Corporation (NVDA) – Yahoo! Finance” https://finance.yahoo.com/quote/NVDA/history?period1=1672617600&period2=1703030400&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true Accessed 18 Dec 2023

- “First Republic shares tumble again as liquidity fears linger – Reuters” https://www.reuters.com/business/finance/first-republic-shares-fall-private-placement-report-stirs-fresh-liquidity-fears-2023-03-20/ Accessed 19 Dec 2023

- “First Republic falls nearly 50% to record low after reporting massive deposit drop – CNBC” https://www.cnbc.com/2023/04/25/first-republic-falls-more-than-40percent-to-record-low-after-reporting-massive-deposit-drop.html Accessed 19 Dec 2023

- “NYSE to delist First Republic Bank shares – Reuters” https://www.reuters.com/business/finance/nyse-delist-first-republic-bank-shares-2023-05-02/ Accessed 19 Dec 2023

- “Oil prices notch biggest gain in nearly a year after OPEC’s surprise output cut – CNBC” https://www.cnbc.com/2023/04/03/oil-prices-surge-after-opecs-surprise-cuts-analysts-warn-of-100-per-barrel.html Accessed 19 Dec 2023

- “Oil rises to highest in 2023 on tight supply expectations – Reuters” https://www.reuters.com/markets/commodities/oil-prices-tick-up-markets-zoom-supply-tightness-2023-09-14/ Accessed 20 Dec 2023

- “Oil climbs 3% as steep US crude stocks draw adds to supply concerns – Reuters” https://www.reuters.com/markets/commodities/oil-prices-edge-higher-markets-focus-supply-tightness-2023-09-27/ Accessed 20 Dec 2023

- “Gold Market Commentary: Gold finishes October on a high – World Gold Council” https://www.gold.org/goldhub/research/gold-market-commentary-october-2023 Accessed 22 Dec 2023

- “Dow closes nearly 200 points higher, as investors shake off rising oil prices from Israel-Hamas war: Live updates – CNBC” https://www.cnbc.com/2023/10/08/dow-futures-open-180-points-lower-after-hamas-attack-against-israel.html Accessed 22 Dec 2023