Semiconductor stocks are constantly reported upon these days, with the most recent headline being NVDA’s near-17% one-day plunge. This was, of course, sparked off by the popularity of DeepSeek, a generative AI model from China that shook confidence in Western tech dominance. [1]

This event neatly encapsulates the allure of semiconductor stocks, but before diving in, it’s important to first build a firm understanding of the background of these stocks, and their current and future trajectory.

What are semiconductor stocks? [2]

Semiconductor stocks are shares of companies specialising in the design, manufacture and distribution of semiconductor chips. Such chips are highly valuable components with wide-ranging applications and demand.

Semiconductors are highly advanced materials that are capable of conducting electrical currents – but only under certain conditions. They are ubiquitous, being used in virtually all modern-day appliances and devices we interact with in our everyday lives. From rice cookers and refrigerators, to vehicles, computers and smartphones, semiconductors play a key role in enabling their intended operation and use.

The modern-day semiconductor chip is nothing short of a technological marvel, with the average computer featuring chips smaller than the palm of your hand capable of performing billions of calculations per second [3]. And they are getting smaller and more capable with each iteration, paving the way for more computational power with smaller footprints and greater energy efficiency.

Perhaps the most salient use case of semiconductors currently is Artificial Intelligence (AI). AI requires large amounts of computing power, and highly advanced semiconductor chips capable of greater efficiency and increased output are key to the development of the AI sector.

Today, semiconductor companies are among the largest in the world, including popular names such as Nvidia, Taiwan Semiconductor Manufacturing Company and Broadcom.

These companies have proven themselves capable of the sophisticated techniques, environs and equipment that are highly sensitive and precise, that are demanded in semiconductor manufacturing. Their specialisation has created a natural moat to competition.

Why trade semiconductor stocks?

Key to the global economy [4]

Given their importance, semiconductor stocks play a key role in the global economy. The digital sector – underpinned by semiconductors – is expected to reach USD $ 16.5 trillion , capturing 17% of global GDP by 2028.

This growth offers potential for investors and traders, with opportunities to benefit from the increasing reliance on digital technologies.

Integral to the AI revolution

In particular, semiconductor stocks are integral to the AI revolution. This is because the availability and capability of semiconductors is an important determinant of AI development.

The AI sector is promising but it is also comparatively young and untested. Thus, trading semiconductor stocks is a way for traders to gain access to the burgeoning AI industry, while at the same time remaining diversified from risks stemming from its fledgling status.

Low correlation to broader market [5]

Semiconductor stocks are highly cyclical, with cycles of supply and demand being a main driver. This characteristic allows semiconductor stocks to have low correlation with the broader market, providing traders with opportunities not found in the broader market.

Additionally, the cyclical nature of the semiconductor industry allow experienced traders time their strategies.

Well suited to variety of timelines and strategies

Lastly, semiconductor stocks are well suited to different types of trading strategies, ranging from long-term plays aiming to capitalise on the sector’s growth potential over time, to shorter-terms strategies focused on cyclical trends.

Furthermore, semiconductor stocks are among the most highly traded securities. This means traders will find that there is high liquidity to support various strategies and objectives.

Examples of top semiconductor stocks

Nvidia Corp (NVDA) [6,7]

Nvidia Corp is a well-known semiconductor chip maker that has been a mainstay of the industry since 1993. While the company had relatively obscure beginnings, it grew into a household name with its well-known line of graphic cards for computer gaming. This specialisation in graphics processing led to an important discovery in 2006 that graphic processing units (GPUs) could be used for computationally intensive workloads, and do so with more efficiency over a traditional processor or CPU.

This led the company towards data centre chip research and development, which would pay off some 20 years later. In 2023, the launch of OpenAI stunned the world, quickly attracting a US$10 billion investment from Microsoft. When investors realised that it was Nvidia’s specialised data centre chips that made OpenAI possible, this sparked off a tidal wave of demand for the company’s stock.

Between Apr 2023 and Apr 2024, NVDA soared a staggering 258%. This was driven not just by AI hype, but also because of its credentials as a data centre leader. Between 2017 and 2024, revenue from its data centre business grew from 12% to 78% of total revenue.

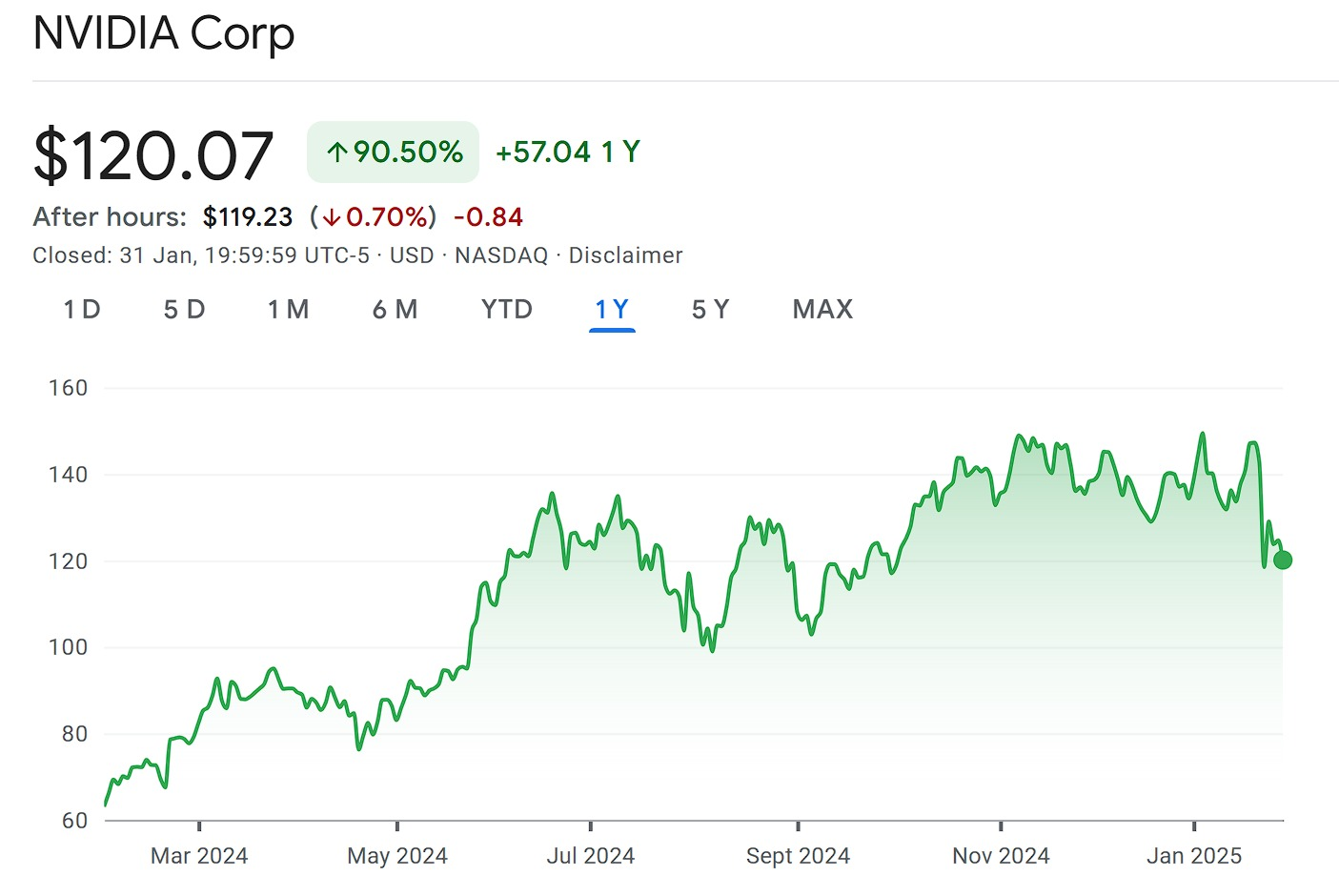

Performance in the past 1 year

As shown in the chart above, NVDA has had a stellar year, with the stock price nearly doubling from US$ 63.03 to US$ 120.07. The rally was far from smooth though, with significant dips in April, August and September 2024.

The latest flash crash took place on 27 Jan 2024 after the announcement of DeepSeek. This was Wall Street’s most severe one-day fall to date in a single stock, evaporating US$ 593 billion of the chipmaker’s value.

NVDA’s dominant position in the stock market was clearly felt when its plunge helped drag down the tech sector. The Nasdaq shed 3.1% amidst the tech selloff.

As of time of writing, NVDA has a total market capitalisation of US$ 2.94 trillion.

Taiwan Semiconductor Manufacturing Company (TSMC) [8]

TSMC is a global leader in the manufacturing and supply of semiconductor chips. It produces at least 90% of advanced chips used worldwide, and is only one of two companies capable of producing 5nm chips – the most advanced chips in widespread use today.

Furthermore, it is leading the development of 3nm chips, which are slated to offer capabilities that supersede those of current-gen 5nm chips, cementing the company’s dominant position for the foreseeable future.

Performance in the past 1 year

As the leading supplier of advanced semiconductor chips, it’s not surprising to see that TSMC had been a beneficiary of the hype-fueled demand for all things AI. Its stock gained nearly 85% from 1 Feb 2024 to 1 Feb 2025, climbing from US$ 113.39 to US$ 209.32.

After a slow start, the stock made a significant rally from Apr to Jul 2024 as the semiconductor sector entered a cyclical boom. The momentum carried through till the end of Nov 2024, until a new record high of US$ 224.62 was achieved on 23 Jan 2025.

This was, however, followed by a plunge to US$192.31 on 27 Jan amidst the recent DeepSeek tech stock rout. Nonetheless, the stock has rebounded with a strong upwards trajectory that looks set to continue.

As at the time of writing, TSMC has a total stock market cap of US$ 907.36 billion.

Broadcom Inc (AVGO) [9,10]

An American multinational company, Broadcom Inc. is a developer, manufacturer and supplier of semiconductor and infrastructure software products. The company is active in several markets around the world, including semiconductor-reliant ones such as data centres, networking and data storage.

As at 2024, 58% of Broadcom’s revenue comes from its semiconductor business, with the remaining made up by its software infrastructure arm. It is renowned for designing and manufacturing advanced semiconductor chips that are used in a wide range of applications,

from smartphones to data centers. Further strengthening its dominant position are game-changing innovations such as WiFi 6 chips for mobile devices.

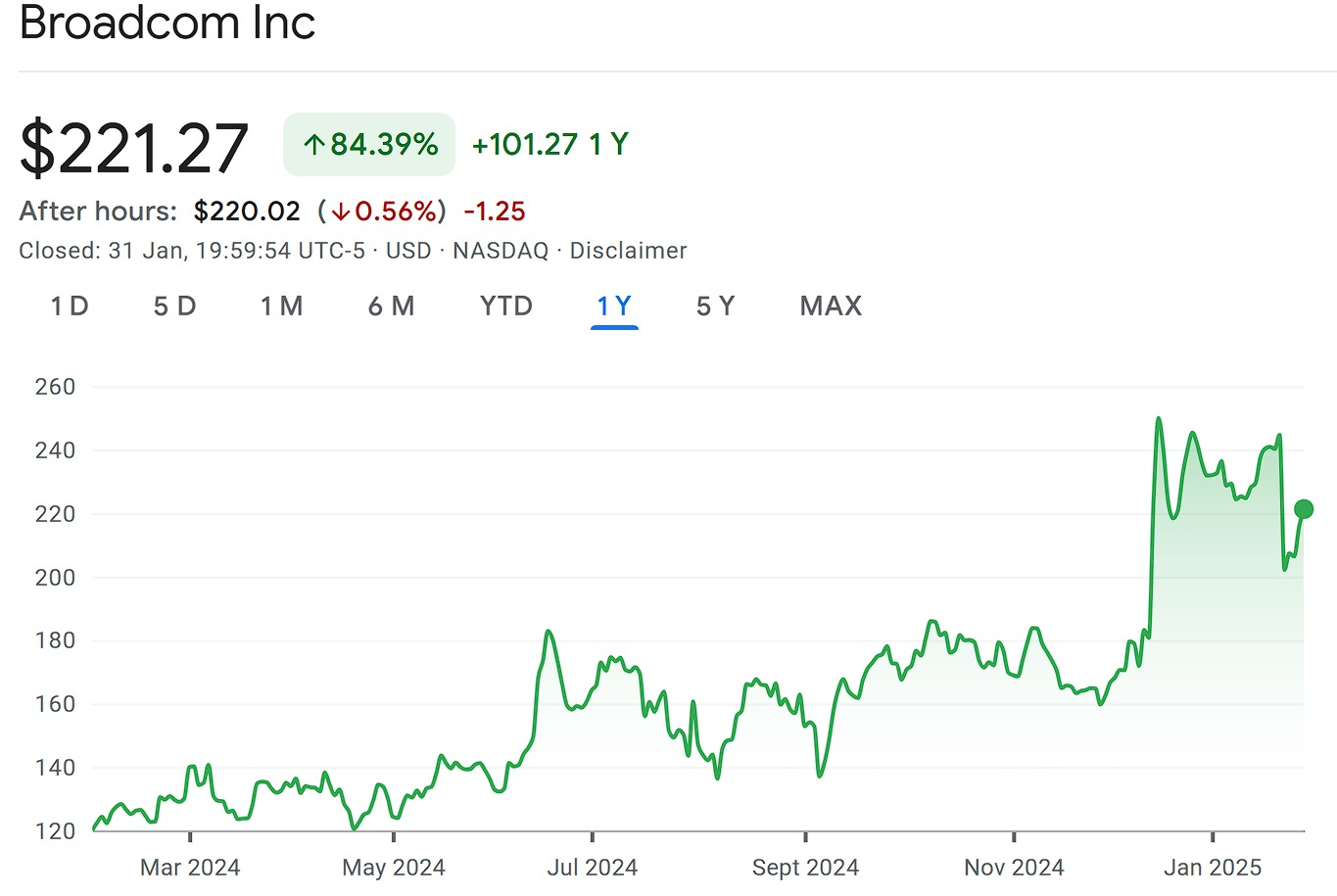

Performance in the past 1 year [11]

AVGO charted a far more choppy price trajectory than pure semiconductor players NVDA and TSMC, perhaps due to its infrastructure software dealings. Nonetheless, it was a spectacular year for investors who managed to hold on throughout the volatility, with an 80% gain over the past 12 months.

Notably, the stock jumped by 43% in December on the back of strong earnings that exceed Wall Street expectations. This was attributed to the company’s strategic acquisition of VMware, and its bright prospects in the AI boom due to its position as a leading supplier of chips used in AI data centre infrastructure.

Risks of trading semiconductor stocks

Supply chain disruptions

The semiconductor sector is highly vulnerable to supply chain disruptions, and this was most keenly felt during the COVID-19 global shutdown, which resulted in a worldwide shortage of chips for everything from cars to phones and computers.

The sector’s supply chain weakness stems from the concentration of chipmaking capacity amongst a mere four companies. Only TSMC, Samsung, Globalfoundries Inc., and United Microelectronics Corp operate foundries required to produce semiconductor chips. Amongst them, the vast majority of production capacity is taken up by TSMC, and followed distantly by Samsung [11].

While the pandemic chip shortage resulted in a rise in semiconductor stock prices initially, as the shortage continued and uncertainty mounted, volatility set in with prices reversing as investors de-risked their portfolios.

Trade wars

The 2018 US-China trade war targeted specific raw materials required in the manufacture of semiconductor chips, resulting in a shortage of 20 mm wafers in 2019. This was exacerbated with the blacklisting of China’s largest chipmaker, SMIC, leading to downstream disruptions and uneven supply of chip making equipment [12].

In a bid to compel investment in US chipmaking capacity, US President Trump has threatened to enact tariffs of up to 100% on chips produced by TSMC. This would spike up costs for customers in the US, which contribute around 70% of the company’s revenue, a development that could significantly impact the manufacturer’s bottomline.

Weather factors

Between mid-2020 to 2021, Taiwan experienced its most severe drought in nearly 100 years. No typhoons made landfall during this period, and rain was recorded at a 56-year low [13].

As water is essential to chipmaking production, this event threatened to worsen the global semiconductor chip shortage triggered by the COVID-19 pandemic. This is because of the 10 foundries operating today, four of them – including chipmaking giant TSMC – are located in Taiwan. Collectively, these four semiconductor manufacturers supply over half of the world’s demand [14].

Consumer demand [15]

Semiconductor stocks can be swayed by consumer demand levels, as most recently seen during the COVID 19 pandemic.

Stay-home orders enacted to limit the spread of the virus sparked a surge in demand for home consumer goods, especially home entertainment, remote working and e-learning equipment. People also started to buy more goods to make their homes more comfortable or functional, due to the increased hours spent indoors.

At the same time, services like e-commerce, food delivery and video conferencing also saw increased demand, leading to greater need for data centres and internet connectivity services.

This global consumer trend was a boon for chipmakers, which saw stock prices and profits soar to record levels from 2020 and 2024. There was, however, a slight dip in 2022.

This was due to several factors, including reduced demand for home goods and services as lockdowns were lifted; global fears of a recession; weaker consumer spending; and export restrictions on selling semiconductors and equipment to China, which could cost up to billions of dollars in revenue over the next few years for several struggling semiconductor firms.

How to trade semiconductor stocks

You can trade semiconductor stocks and sector-based ETFs with Vantage CFDs. Follow these steps to start trading:

1) Sign up for a Vantage live account.

2) Once your account is approved, fund your account to start trading. You can start trading from $50.

3) Choose your preferred trading platform, including MT 4 and MT 5, web-based platforms, or the Vantage mobile app.

4) Select your preferred semiconductor stock or ETF and place your first trade using CFDs.

To practice without risking real money, sign up for a demo account and test strategies using real-time data.

Conclusion

We’re at a critical point in technology, and semiconductor stocks offer a front-row seat to the action. It is undeniable that AI and digital technology will continue to expand, making the semiconductor sector an important part of the global economy, with growth potential driven by advances in these technologies.

While opportunities exist, it’s important to assess the risks and not assume that early investments will always pay off. The volatility associated with these stocks, their cyclical nature, and the vulnerabilities within the sector should be considered. It’s crucial to educate yourself thoroughly on the characteristics of chipmakers and apply proper risk management techniques.

References

- “DeepSeek sparks AI stock selloff; Nvidia posts record market-cap loss – Reuters” https://www.reuters.com/technology/chinas-deepseek-sets-off-ai-market-rout-2025-01-27/ Accessed 1 Feb 2025

- “Semiconductors and Advancements Investors Should Watch Out For – Investopedia” https://www.investopedia.com/semiconductor-impact-on-the-stock-market-7367723 Accessed 1 Feb 2025

- “How Many Calculations Can A CPU Do Per Second – MS.codes” https://ms.codes/blogs/computer-hardware/how-many-calculations-can-a-cpu-do-per-second Accessed 1 Feb 2025

- “The Global Digital Economy Will Reach $16.5 Trillion And Capture 17% Of Global GDP By 2028 – Forrester” https://www.forrester.com/blogs/the-global-digital-economy-will-reach-16-5-trillion-and-capture-17-of-global-gdp-by-2028/ Accessed 1 Feb 2025

- “The Truth Behind Trading Semiconductor (Chip) Stocks – Investopedia” https://www.investopedia.com/articles/active-trading/031815/truth-behind-trading-semiconductor-chip-stocks.asp Accessed 1 Feb 2025

- “NVIDIA Is A Data Center Company Now – Forbes” https://www.forbes.com/sites/tiriasresearch/2019/03/29/nvidia-is-a-data-center-company-now/ Accessed 1 Feb 2025

- “Here’s the Big Reason Nvidia Stock Has Exploded 258% Higher in the Past Year – Nasdaq” https://www.nasdaq.com/articles/heres-the-big-reason-nvidia-stock-has-exploded-258-higher-in-the-past-year Accessed 1 Feb 2025

- “Taiwan Makes the Majority of the World’s Computer Chips. Now It’s Running Out of Electricity – Wired” https://www.wired.com/story/taiwan-makes-the-majority-of-the-worlds-computer-chips-now-its-running-out-of-electricity/ Accessed 1 Feb 2025

- “Broadcom Announces World’s First Wi-Fi 6E Chip for Mobile Devices – Broadcom” https://investors.broadcom.com/news-releases/news-release-details/broadcom-announces-worlds-first-wi-fi-6e-chip-mobile-devices Accessed 1 Feb 2025

- “Why Broadcom Stock Soared 44% in December – The Motley Fool” https://www.fool.com/investing/2025/01/06/why-broadcom-soared-44-in-december/ Accessed 1 Feb 2025

- “How A Chip Shortage Snarled Everything From Phones To Cars – Bloomberg” https://www.bloomberg.com/graphics/2021-semiconductors-chips-shortage/ Accessed 1 Feb 2025

- “Global Chip Shortage: Timeline & Key Events | Fusion Worldwide – Fusion Worldwide” https://www.fusionww.com/insights/blog/the-global-chip-shortage-a-timeline-of-unfortunate-events Accessed 1 Feb 2025

- “Taiwan’s Water Crisis – Commonwealth Magazine” https://www.cw.com.tw/graphics/drought-2023-en/ Accessed 2 Feb 2025

- “Looming Effects Of Continued Drought In Taiwan – Fusion Worldwide” https://www.fusionww.com/insights/blog/manufacturers-in-taiwan-deal-with-drought?hsLang=en Accessed 2 Feb 2025

- “Semiconductors and Advancements Investors Should Watch Out For – Investopedia” https://www.investopedia.com/semiconductor-impact-on-the-stock-market-7367723 Accessed 2 Feb 2025