Dovish BoC and strong US data boost stocks

Headlines

* Bank of Canada’s Macklem fires starting gun on rate reductions

* S&P 500 and Nasdaq 100 hits records as Nvidia soars

* USD gains after stronger-than-expected ISM services sector data

* ECB nailed on to cut rates Thursday, next steps unclear

FX: USD enjoyed strong Services data while a mixed ADP jobs print didn’t do much damage. The survey reading was the highest since August 2023. Prices paid eased, while the employment component, ahead of Friday’s NFP, remained in contractionary territory. The dollar index touched the 200-day SMA at 104.43 before paring gains.

EUR closed modestly lower after solid final PMIs pointed to an improving growth outlook ahead. All eyes are on the ECB meeting today with a first rate cut baked in. “Cautious and gradual” is expected to be the bank’s approach going forward.

GBP managed to make small gains though prices remain below 1.28. The multi-week high yesterday printed at 1.2817. Final PMI data stayed decent with a sixth month of expansion in the composite. Cable will be moved around partially by the euro tomorrow and then the greenback on Friday.

USD/JPY virtually reversed all the prior day’s losses, even though the 10-year US Treasury yield sunk further, settling at 4.27%. The currency major bounced off the 50-day SMA at 154.88. The carry trade unwind seen since the Mexican election paused. MXN/JPY was one of the most widely traded strategies with the cross falling 8% this week before the reversal.

AUD showed no immediate reaction to soft GDP, though the prior was revised higher by one-tenth. CAD sold off after the BoC rate cut. That had been mostly expected, but Governor Macklem signalled more reductions are coming if inflation continues to ease. He also said the bank is not near the limit to how far the Fed and BoC can diverge. There’s around a 40% chance of a back-to-back July cut, with a September move fully priced.

US Stocks: Indices were strong, though the Dow lagged again as tech took the Nasdaq 100 and broader S&P 500 to fresh record closing highs. The S&P 500 finished higher by 1.18% at 5,354. The Nasdaq 100 settled 2.04% up at 19.035. The Dow closed in the green by 0.25% at 38,807. Tech jumped 2.7% as the biggest sector gainer while utilities posted the largest drop. Nvidia again grabbed the headlines, surging 5.16% to settle on its highs at $1224. For the first time ever, the chip behemoth closed as the second largest public company in the world.

Asian Stocks: APAC futures are in the green. Asian stocks traded mixed after the cautious Wall Street handover. The ASX 200 was marginally higher with gold names lagging. The Nikkei 225 underperformed again with auto continuing to suffer and industrials also softer. China stocks were varied with the mainland helped by auto stocks.

Gold rebounded by 1.23% as its recent see-saw price action continued. Bond yields slid lower helping, though the dollar found buyers. The 50-day SMA now sits at $2337.

Day Ahead – ECB Meeting

The ECB will be the third major central bank to lower rates after the SNB and BoC. It will cut its deposit rate by 25bps to 3.75%. That would be its first reduction since September 2016. Governing Council members have told us as much in recent weeks. We also get updated June economic staff projections. These are widely expected to suggest the prevailing monetary policy and economic narrative stays broadly unchanged.

The rate move might be deemed a “hawkish cut”. Whatever it is, with inflation still sticky and the labour market still hot, the ECB will likely not be specific on any more rate cuts in the near term. Policymakers will reaffirm their data dependence, perhaps numerous times, as this is not predicted to mark the start of a traditional cutting cycle.

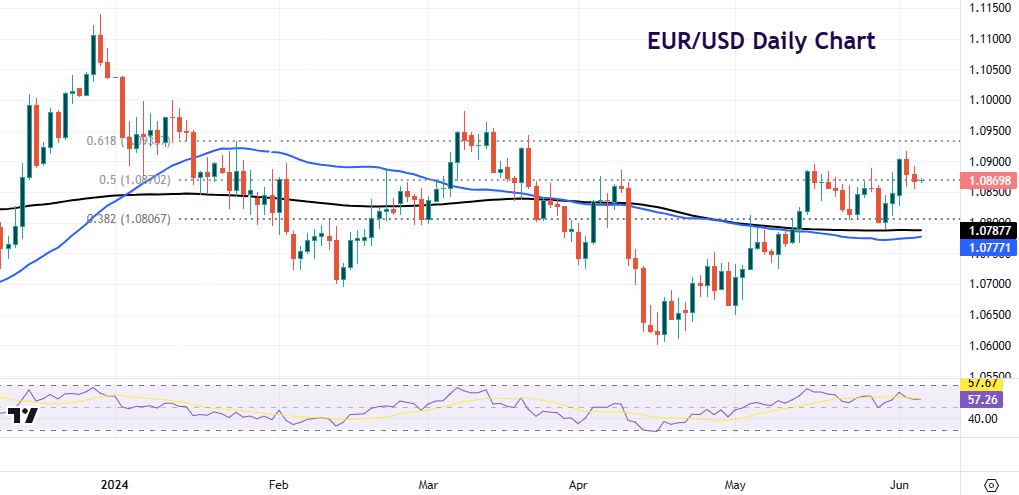

Chart of the day – EUR/USD near cycle highs

A lack of guidance by the ECB could be read as a hawkish signal and give some support to the euro in the short term. However, the fact that the ECB has moved before the Fed, which is battling higher inflation and wages, should make markets quite comfortable with jumping back into pricing in two more cuts in 2024 (after today’s move). Markets have little priced for the 18 July meeting and about half of another 25bps cut priced for September. That means there is scope for the near-term forward rate path to be impacted by President Lagarde’s words.

The near two-month bull run in the world’s most popular currency pair remains in play. But the pullback from above 1.09 warns of some consolidation. Prices are currently sat on the midpoint of the December high to April low at 1.0870. Strong support sits around 1.08 with a major Fib level (38.2%) and the 200-day SMA just below here.