Geopolitics and Trump remain front and centre

- Trump said to eye a deal with China, attacks Ukraine’s Zelensky as a “dictator”

- FOMC minutes show officials cautious amid uncertainty

- UK inflation reaches 10-month high complicating BoE’s rate path

- USD and stocks relatively quiet and unmoved

FX: USD saw some buying for a second straight day with prices near the October 2023 high at 107.34. More Trump tariff threats mean ongoing major uncertainty over trade policy endures. The Fed minutes reiterated the multiple indications from Fed Chair Powell that there is no rush to cut rates and they should be cautious with future adjustments. Pausing the balance sheet run-off caused some very mild selling in the greenback. Otherwise, all the focus is on Ukraine and the increasingly scathing remarks from President Trump – just rhetoric to set up a deal or something more concrete?

EUR was the worst major performer as question marks are raised about future Moscow-Washington cooperation. That can reinforce the notion of isolation for Europe from a defence and economic perspective and contribute to a rotation away from European currencies into safe haven USD and JPY. Investors are starting to eye Sunday’s German federal election which is expected to deliver a win for the centre-right CDU. But it may also reflect a jump in support for the far right AfD.

GBP turned lower after struggling around 1.26 for a couple of sessions. UK CPI pushed higher as expected though crucial services inflation printed below forecasts. Cautious policy adjustment is the name of the BoE game.

USD/JPY dropped as BoJ hawk Takata supported more rate hikes. There is around 15bps priced in for the June meeting. Strong support sits around 154.32 – see below for more detail.

AUD edged lower but is still consolidating in the recent range around 0.6250. Eyes are on today’s jobs data. USD/CAD turned higher for a third straight day but remains under the 1.4268, which is the 38.2 Fib level of the September to January move.

US stocks: The benchmark S&P 500 rose 0.24% to settle at 6,144. The tech-laden Nasdaq finished up 0.05% at 22,175. The Dow gained 0.16% to close at 44,627. That was another record high and close for the benchmark S&P 500. Health and Consumer Staples led the winners while Materials and Financials were the only sectors in the red. Apple debuted the iPhone 16E, a lower cost model available for $599 pre-order on Friday. Some analysts had thought the price would be lower. Intel slid 6% after its surge on Tuesday on reports different parts of the company may be bought by Broadcom and TSMC. Meta fell again, down another 1.85 after its record win streak.

Asian stocks: Futures are mixed. Stocks were mixed again with choppy performance on more Trump tariff threats on autos, chip and pharm imports, and the US-Russia Ukraine talks. The ASX 200 fell as energy and financials lagged on banking results. The Nikkei 225 dipped as export data and machinery orders disappointed. The Hang Seng and Shanghai Comp were varied as Hong Kong slid giving up some of Tuesday’s tech-driven gains, while gains. The mainland climbed on AI optimism and Beijing’s pledges to support private enterprise.

Gold pulled back after making a fresh intraday top at $2946. Haven demand and physical issues keep an ongoing bid going forward.

Day Ahead – Australia Jobs, Japan CPI

Consensus expects 20k jobs added, less than the prior 56k. January has typically been a weaker month of job creation in recent years due to seasonal patterns. That’s down to the timing of new jobs and people taking leave. The jobless rate is predicted to tick up one-tenth to 4.1%. The RBA was relatively hawkish earlier this week, even though it cut rates for the first time since 2020. For the aussie, high exposure to the trade story and risk sentiment will do battle with any short-term benefits from the RBA’s tone.

Japan headline inflation is expected to rise to 4% in January, mainly due to a surge in food prices. Tokyo CPI, a forerunner to the nationwide figures, rose at its fastest pace in nearly a year. Core inflation is forecast to accelerate to 3.2% y/y and core excluding food and energy is seen rising two-tenths more than the prior 2.6%.

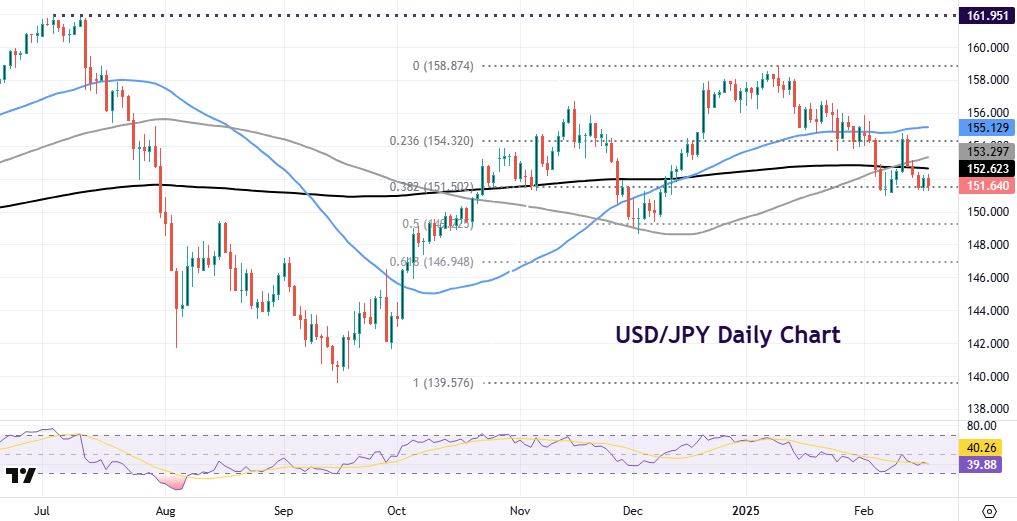

Chart of the Day – USDJPY on recent lows

USDJPY has fallen back after finding resistance around 154.32 during the middle of last week. We recently heard from BoJ hawk Takata who the bank should consider gradual policy tightening to contain inflation risks. But ongoing tariff concerns modestly negated the downside pressure on USDJPY. Trump’s mention of 25% tariffs on autos is likely to impact Japan as US is one of Japan’s largest trading partners. Japanese cars are amongst the top five most popular in US and the auto industry is a key component to Japan’s economy. Officials have already sought exemption from the US, but the status and how reciprocal tariffs may pan out for Japan remains unclear.

USDJPY has been consolidating and sits just above support at 151.50 (38.2% Fib retracement of September low to January high). Resistance is the 200-day SMA at 152.62 and 153.29, the 100 SMA.