Markets choppy as ECB cuts amid more tariff noise

- Tech and chipmakers lead the declines on Wall Street

- Euro rises to a four-month high as ECB cuts, before retracing

- ECB changes statement language as the door to more cuts is closing

- Gold steady and consolidating ahead of today’s US non-farm payrolls data

FX: USD dropped again tapping a big retrace level at 104.98 before clawing back losses on more tariff roll backs. US employers announced the biggest value of job cuts since July 2020. US exceptionalism is weakening and will be tested by today’s NFP data. Yield differentials have narrowed hugely this week as growth prospects potentially reverse between the US and Europe. Trade war worries and DOGE are very much losing out to the European fiscal bazooka. As a Bloomberg columnist said, “Sometimes you can feel the global economy’s tectonic plates move under your feet.”

EUR tried to push past a major Fib retracement level (61.8%) of the September -January decline at 1.0817 but failed and eventually closed marginally lower. Prices are overbought and hint at a short-term peak. The ECB cut rates as expected for the sixth time in nine months, but the euro barely moved on the announcement or press conference. Going forward, President Lagarde stressed data dependence and the high degree of uncertainty. However, a clear signal came in new wording that the bank is near neutral. The giant incoming fiscal stimulus might finally do some of the ECB’s heavy lifting to support growth. That means a pause at the next meeting is highly possible.

GBP underperformed having ridden on the back of super strong European FX in recent days. Cable was modestly lower on the day having touched the next major resistance level above 1.29. That’s the retracement of the September/January drop at 1.2924.

We are also watching EUR/GBP that could be building a long-term base above 0.82. The seismic fiscal shift this week in the eurozone could fire up the region. The 200-day SMA is resistance at 0.8384 after three strong days of buying. That said, late selling saw a bearish near-term daily candlestick.

USD/JPY broke down again as haven currencies like the yen and CHF outperformed on broad market uncertainty. Rengo, Japan’s largest labour union, is now seeking a wage hike of 6.09% for 2025 ( 5.85% in 2024). Money markets maintain their more aggressive pricing for upcoming BoJ hikes, with 35bps of hikes seen by year-end and the first fully priced in September. There is a major retracement level of the September/January rally (61.8%) at 146.94.

AUD gave back its gains. The 100-day SMA remains above at 0.6378. Better-than-expected building approvals and a larger trade surplus failed to move markets massively. USD/CAD dropped again as the auto reprieve implications continued. See below for more on the loonie.

US stocks: The benchmark S&P 500 lost 1.78% to settle at 5,738. The tech-dominated Nasdaq finished down 2.79% at 20,052. The Dow fell 0.99% to close at 42,579. Only one sector was in the green – energy while tech was the major loser. The SOX semiconductor index lost 4.5% on a disappointing Marvell report. President Trump said there is no USMCA exemption for auto tariffs next month. He told automakers this is a short-term deal and not to come back on April 2.

Asian stocks: Futures are negative. APAC stocks were mixed but mainly in the green after the decent handover from Wall Street. The ASX 200 fell to a fresh y-t-d low on sinking energy and utilities. The Nikkei 225 didn’t hold its initial gains but settled in positive territory. The Hang Seng and Shanghai Composite continued advancing north amid the ongoing “Two Sessions” and recent spending announcements.

Gold closed slightly lower on the day. The record high sits at $2,956. The dollar was little changed after sinking initially, while beaten-up yields picked up for a third straight day before bonds went bid and yields fell.

Day Ahead – NFP, Canada Jobs

It’s the first Friday of the month, which means the release of the US monthly jobs report and so one more big risk event for markets to navigate. Consensus sees 165k jobs added, which would be down from the prior weather-related 143k. The average pace since the start of 2024 is 165k with the three-month average of 237k. The unemployment rate is predicted to remain steady at an eight-month low of 4.0%. We note the Fed December projection is 4.3% at the end of 2025. Wage growth is seen cooling at 0.3% m/m from 0.5% which was the highest rate in around a year.

Job cuts initiated by DOGE are expected to take a few months to feed into the data, though the government payrolls figure will grab the attention. Other job indicators point to a soft report with the PMI employment figures recently falling below 50 for the first time in 3 months. With all this week’s volatility fresh in the mind, anything approaching an inline set of figures will see the market breathe a huge sigh of relief.

Canada February jobs growth is expected to cool after January saw 76k jobs added. The unemployment rate ticked one-tenth lower to 6.6%. The odds of another 25bps rate cut at the BoC meeting next week have risen this week above a coin flip at the end of last week.

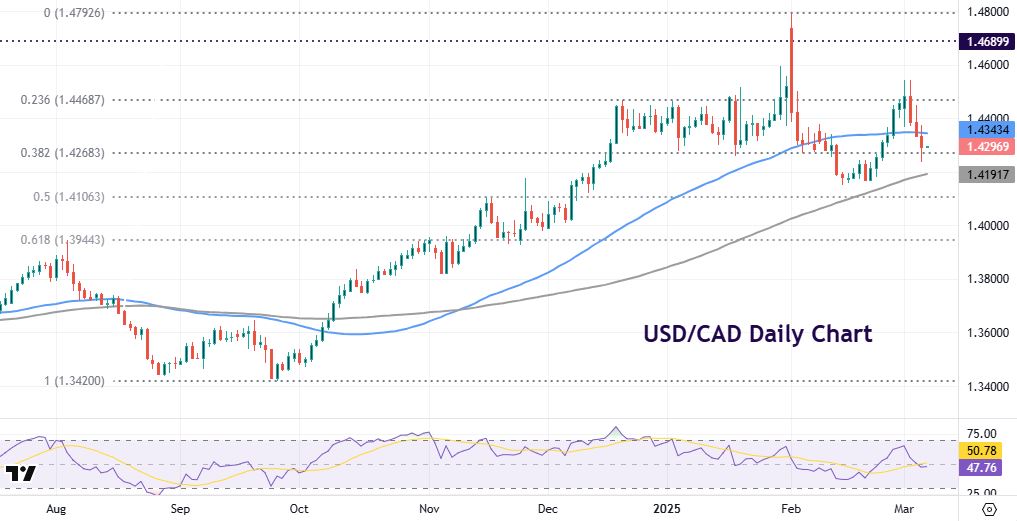

Chart of the Day – USD/CAD drops after tariffs announced

It’s a strange day when US tariffs get announced and USD currency gets sold while the country that is getting hit sees their currency (CAD, MXN) appreciate. Such is the way as markets look through the initial announcements and takes the positives out of a reduced final tariff. After the auto reprieve, economists reckon the effective regime on Canada will be about 14%.

This major has taken the brunt of the tariff threat, delay, announcement and reprieve news. Prices had been consolidating around 1.42 after the initial spike to multi-year highs near 1.48. In the lead up to this week’s deadline, the major found resistance above 1.45 after seven straight days of buying. Since the border tariff deal, prices have fallen for three days in a row to a major Fib level at 1.4268. The 100-day SMA sit at 1.4186, more or less support from mid to late February.