Markets quiet, eyes on BoE and SNB central bank meetings

Headlines

* US stocks and bond markets closed for Juneteenth holiday

* European markets close slightly lower, FTSE ticks up

* Bank of England set to give dives the summertime blues

* Swiss central bankers lean towards another rate cut

FX: USD were flat with markets quiet on Juneteenth holiday in the US. The long-term ascending upward trendline from the December 2023 low comes in around 105.09. The 50-day SMA is at 105.20.

EUR steadied some more in a narrow trading range printing a small doji candle. Prices remain above 1.07. Yesterday’s softer US retail sales have helped this, while French political angst stabilises.

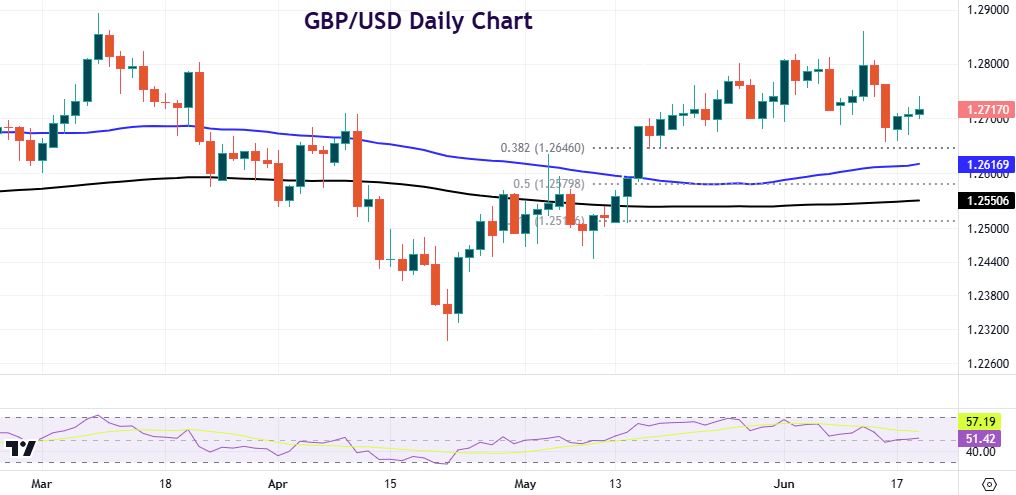

GBP stayed above 1.27 to finish in the green for a third consecutive day. Headline inflation hit the BoE’s 2% target for the first times since 2021. But services inflation printed two-tenths above estimates and 0.4% above the most recent BoE forecast.

USD/JPY edged again very marginally higher. The recent top is 158.25. The 10-year Treasury yield very modestly dipped in very quiet trading.

AUD continuesto outperform this week. The aussie is building on the mildly hawkish RBA meeting. The Board is more alert to upside inflation risks as it feels less certain that persistent price pressures are moderating. A resistance zone sits just above 0.67. CAD strengthened for a fourth straight day with sellers overcoming initial buying and settling lower on the day. Prices are now sat above the 50-day SMA at 1.3696.

US Stocks: Wall Street was closed. We’ve been checking the performance of Nvidia and thought it was worth mentioning. The world’s most valuable company is up 40% on the month and 170% in 2024. It has surpassed Apple and Microsoft who has been jostling for the top spot for over a decade. ExxonMobil was the last Us company to beat both of those, back in 2011. The current levels of concentration in the market haven’t been seen since 1999. That tech bubble went from 1997 until March 2000 so it had a relatively long runway.

Asian Stocks: APAC futures are in the red. Asian stocks were generally in the green after more record highs on Wall Street. The ASX 200 was muted as losses in industrials were tempered by stronger miners. The Nikkei 225 was positive though early gains were given up. The Hang Seng outperformed with property stocks strong, while the mainland lagged amid more trade frictions.

Gold traded in a very tight range in quiet trade with the US on holiday.

Day Ahead – BoE and SNB Meetings

The SNB meeting will be of interest to see if they cut rates again, after the central bank led the pack a few months ago. There’s above a 70% chance of that happening. The swissie has strengthened a lot recently with USD/CHF and EUR/CHF moving sharply lower. The assumption is that the bank needs to cut rates again or else the pairs fall further. But will the bank want to signal back-to-back rate cuts when Chair Jordan recently warned about upside inflation risks?

The BoE meeting should be more straight forward with no move priced in and very few, if any, tweaks to the statement. This is not a quarterly meeting so there are no projections or press conference. Services inflation probably put paid to any big hints at policy easing in the near term. August rate cut bets have dropped today to just above 30% from 46% pre-CPI, with September currently a lock for a first reduction.

[An apology is due as we got our time zones and dates mixed up yesterday. That means NZ GDP is early today and we covered this and NZD/USD in yesterday’s Day Ahead. First quarter New Zealand GDP is expected to edge back above zero. Some economists expect a decline, which would mark the fifth drop in the last six quarters. This isn’t likely to move the needle dramatically regarding RBNZ policy, with the first rate cut not seen until the end of the year].

Chart of the day – GBP/USD holding above 1.27

Cable continues to find firm support in the upper 1.26. That is where sterling has based consistently in the past few weeks. But there is little staying power in gains which have struggled to hold 1.28+ levels, after last week’s bearish close. It seems like the pound is desperately trying to establish a base. That means holding in 1.27 or upper 1.26s at a minimum, before it can steady and improve. But, if it’s a dovish hold and there is hint of an August rate cut by the BoE in the statement only meeting, we could see sellers challenge 1.2656/58 and the Fib level below at 1.2646.