Record closes on Wall Street, EUR sinks after poor PMI data

* Israeli strikes kill more than 270 in Lebanon, gold posts fresh record close

* Eurozone’s teetering economy fuels bets on faster ECB rate cuts

* German IFO Business morale poised for fifth straight decline as growth ebbs

* RBA to hold rates at 4.35% but economists split on when rate cuts will come

FX: USD is hovering just above major long-term support at 100.61. Buyers were seen early in the session on weak European PMI data. But softer US survey figures saw the index give back gains. Last week’s FOMC low was at 100.21. There are at least nine Fed officials scheduled to speak this week, including prepared remarks from Chair Powell.

EUR sank to a low at 1.1083 and just below the 21-day SMA before rebounding. German and French PMI data disappointed with both Composites now sub-50. That put the region’s number at 48.9, well below the 50.5 expected. Stagnation is spreading in the zone and markets now assign a 40% chance of another rate 25bps cut next month. The previous cycle top from December is 1.1139 with recent highs around 1.12.

GBP outperformed, bar the antipodeans, with fresh new cycle highs. PMI data was softer but still highlighted “UK Exceptionalism” with all measures still in expansionary territory above 50. Bullish momentum is relatively solid in cable while EUR/GBP broke through a long-term low from August 2022 at 0.8339.

USD/JPY traded in a narrow range just above the 21-day SMA at 143.42. The more dovish than expected remarks from BoJ Governor Ueda on Friday saw the yen underperform last week with a 2% decline. A long-term retracement level (50% of the 2023 low to 2024 high) sits at 144.58.

AUD made fresh highs, hitting levels last seen in December 2023. This comes ahead of the RBA, which is expected to remain the last central bank to pivot entirely to a dovish stance. A PBoC rate cut helped sentiment, with more stimulus potentially to follow. USD/CAD sunk below the 21-day SMA at 1.3538. Equities were firmer while the China stimulus news helped buoy commod$s.

US Stocks all closed marginally in the green in a relatively quiet day of trading. The S&P 500 gained 0.28% to settle at 5,718. The tech-heavy Nasdaq 100 added 0.31% to finish at 19,852. The Dow closed 0.15% higher at 42,124. The benchmark broad-based S&P 500 settled at a record close, the 40th of 2024. The index is now up in nine of the past 11 trading days and added 19.89% this year. Fed officials expressed support for the recent rate cut and suggested a preference for more in the coming months. Bets are currently a coin flip between a 25bps or a 50bps move in November, with 74bps in total for this year. Tesla climbed 4.9% as investors looked forward to the launch of the robotaxi and incoming Q3 sales figures.

Asian stocks: Futures are mixed. Asian stocks were mostly in the green though geopolitical issues dominated over the weekend. The ASX 200 traded lower with soft PMIs not helping. The Shanghai Composite and Hang Seng were better bid after the PBoC cut the 14-day reverse repo rate and ahead of next week’s National Day holiday.

Gold moved higher even as the dollar was relatively steady and yields moved north too. Speculators and hedge funds are holding the largest futures bets on higher prices since 2020.

Day Ahead – RBA Meeting

The RBA is likely to keep the Cash Rate unchanged at 4.35%. The last meeting in August saw the bank strike a hawkish tone, not ruling anything in or out, while it reiterated that inflation remains above target and is proving persistent. It also raised its view for GDP, CPI and the Unemployment Rate with its forecasts assuming the cash rate will be 4.3% in December 2024, where it currently stands. RBA Governor Bullock has been hawkish since, with a cut not on the near-term agenda, they are ready to raise rates if needed and that the pricing of cuts for the next six months does not align with the board.

It seems it is still too premature to be thinking about rate cuts and the Board want to see results on inflation before lowering rates. This suggests the central bank is far from cutting rates, especially given that the latest monthly inflation data for July topped estimates and remained above the central bank’s 2%-3% We note the monthly CPI indicator for August is released on Wednesday.

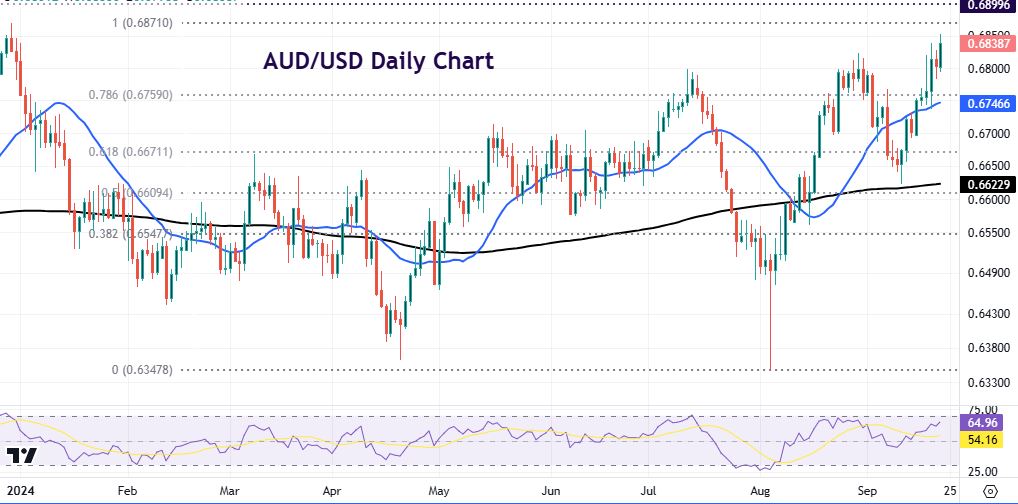

Chart of the Day – AUD/USD heading into long-term resistance

The Reserve Bank of Australia is expected to continue to hold its semi-hawkish line today, which means it will be the last of the G10 central banks to cut rates. That has seen the aussie perform relatively well this month versus the greenback, standing in third place amid its global currency peers.

After spiking lower to 0.6347 at the start of August, AUD/USD has gone north. The major paused around the mid-July highs around 0.68 late last month. Prices fell back to the 61.8% retracement level (December high and August low) at 0.6671 but didn’t quite reach the 200-day SMA at 0.6622. The rebound has taken the major to fresh year-to-date highs. Bulls are looking at that December top at 0.6872. The June 2023 peak is at 0.6899 and the 200-week SMA at 0.6961.