Thin markets, USD looking weak as gold rises

Headlines

* US markets closed for Thanksgiving, thin liquidity into next week

* EUR rises above 1.09 as investors cling to glimmer of better PMI data

* Oil slides on bearish view of delayed OPEC+ meeting

* Gold closes marginally higher, still below $2000 in narrow range day

FX: USD printed an inside day with prices trading in a narrow range on Thanksgiving. Bond markets were closed amid thinner volumes elsewhere. Markets are looking ahead to US PMI data.

EUR edged higher after PMI data showed recession in Germany may be shallower than expected. That offset poor French figures. But all measures remain in contraction territory with manufacturing contracting every month since July last year.

GBP outperformed and printed a 10-week high at 1.2572 before pulling back. The UK’s Autumn Statement was marginally positive for sterling. Tax cuts point to a better growth outlook and stickier price pressures. This supports a higher for longer rates bias by the BoE. Today’s PMI services printed back above 50 again, which was also encouraging.

USD/JPY traded around the 50-day SMA at 149.57. The major finished near to its highs for the day. Eyes are on Japanese CPI data out Friday.

AUD continued to consolidate its recent gains with resistance at the 200-day SMA at 0.6585. The 50% point of the summer decline sits at 0.6584 to reinforce this zone.

Stocks: US equities were closed.

Asian futures are in the green. APAC stocks were mostly subdued on Thursday with Japan on holiday. The ASX 200 was dragged lower by weak PMI data and losses in commodity sectors.

Gold closed modestly higher but below $2000 printing an inside day candle. US Treasury markets were closed for Thanksgiving.

Day Ahead – Japan CPI and New Zealand Retail Sales

Further weakness is expected in NZ retail sales. This comes despite more tourists and population growth. Consensus expect the headline to fall 0.8% and core activity is forecast at -1.5%. NZD moved to a three-month high earlier in the week just below the 200-day SMA at 0.6091. But the major has been tracking sideways since around 0.6050.

Japan national CPI is expected to print at 3%, two-tenths above the prior 2.8%. This was the first time in over a year that the rate had fallen below 3%. Prices of fresh food and energy will drive CPI higher. Core inflation, which strips out those two elements, is likely to stay above 4%. This is seen pushing the BoJ towards a more neutral bias next year, from its long-standing ultra easy stance. Watch out for the Spring wage talks which the bank is emphasising will be key for policy.

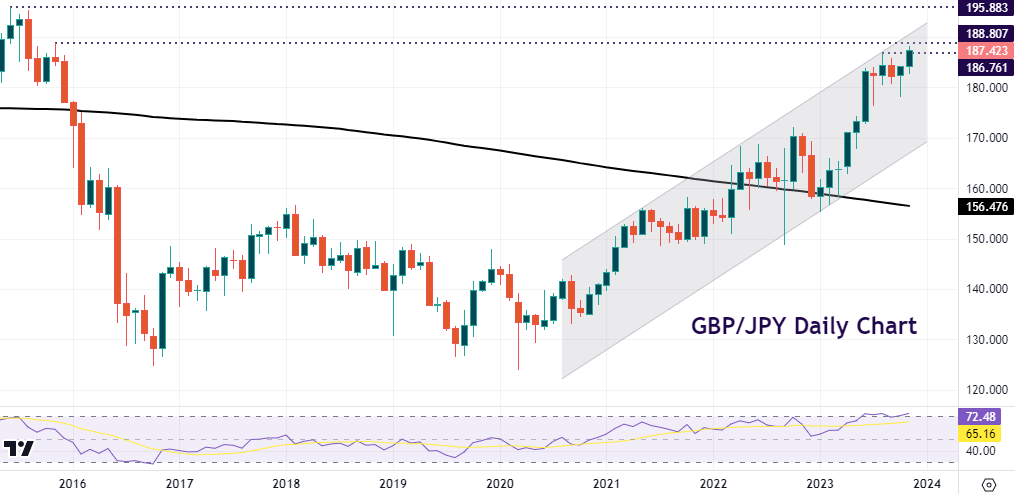

Chart of the Day – GBP/JPY long-term bull channel intact

We use multiple timeframe analysis when picking out favourable trade set ups. This generally means using a lower timeframe in order to enter a higher timeframe pattern. The breakout in GBP/JPY caught our eye with the upside move at the end of last month and beginning of November. This strong move higher after a few weeks and months of tracking sideways could mean there is more upside to come, after a previous strong breakout higher in May and June.

Prices surged through the August high at 186.76 last week so a strong weekly close will be significant, especially if it clears the near-term high at 188.24. If prices confirm that upside break, we are looking at long-term level like the high from November 2015 at 188.80. The 2015 top at 195.88 is a target for the bulls. That said, prices are overbought on several long-term momentum measures.