Stocks post mixed earnings but Netflix jumps after hours

Headlines

* Netflix beats subscriber numbers as revenues and profits bump

* Dow slips 150 points after a batch of disappointing earnings

* Bank of Canada policymakers likely not yet ready to pivot

* Traders pare BoE rate cut bets, see fewer than 100pbs this year

FX: USD broke higher above the 200-day SMA at 103.47. Bullish seasonal trends are seemingly helping the greenback. More importantly, US yields pushed north again. The 10-year has found support at the 200-day SMA at 4.09% and eyeing up the recent high at 4.19%.

EUR broke down through the day after recent consolidation above the 200-day SMA at 1.0844. Next support is around 1.0780. But the major bounced off the lows at 1.0821. There wasn’t much news to drive price action. The ECB bank lending survey reported a moderate tightening in credit standards with higher rates still dampening loan demand.

GBP popped up to 1.2747 in early trade before succumbing to dollar strength. Again, there was little news driving price action. The recent range in cable is 1.26 to 1.2828.

USD/JPY sold off to a low just below 147 before reversing and settling above 148. The BoJ meeting saw the door left ajar for policy normalisation in the not-too-distant future. Governor Ueda said certainty around the price outlook was rising and the BoJ would consider raising rates if the bank’s price goals are in sight. But the timing in still uncertain with the Spring wage negotiations in focus. The recent high in USD/JPY is 148.80.

AUD and NZD held up relatively well on hopes for a major China stock rescue plan ramp up. The aussie dipped below the 200-day SMA at 0.6578. Support under here is at 0.6516/28.

Stocks: US equities again extended their record closing highs with tech outperforming. The benchmark S&P 500 advanced 0.29% to settle at 4,864. The tech-heavy Nasdaq 100 added 0.43% to finish at 17,404. The Dow Jones underperformed closing 0.25% lower at 37,905. This was the third straight record close for the broad-based S&P 500. All the “Magnificent Seven” advanced on the day. Mixed earnings saw GE disappoint while Procter & Gamble and Verizon surprised to the upside. Netflix jumped over 8% after hours. The streaming giant said it added a consensus-beating 13.1mn subscribers and topped revenue estimates as its membership push gained steam.

Asian futures are mixed. APAC stocks gained on reports of the Chinese equity market rescue package. More record highs on Wall Street also helped. The Nikkei 225 extended gains after the BoJ stood pat. But the index hit resistance just below the 37,000 level and retraced. The Hang Seng was boosted by the rescue package reports and bounced off multi-year lows. But Shanghai lagged as wider measures including the property sector will likely be needed in the long term.

Gold continues to oscillate around the 50-day SMA at $2023. March Fed meeting rate cut odds are now down near 40%. They were well above 80% a few weeks ago.

Day Ahead Data Focus – PMIs

The PMI surveys are good indicator for how economies are faring and will do in the months ahead. Economic activity in the eurozone remains grim, though there are hopes that manufacturing is bottoming out. Its PMI has been below 50 for year and a half, while the services sector has moved sideways over the last couple of months. Economists will focus particularly on the inflation outlook and prices paid elements.

Expectations are for a rise in UK PMIs, though the manufacturing sector remains subdued way below 50. Lower borrowing costs and the March budget may give a lift to the figures. But supply disruptions in the Red Sea rather than improved demand could affect the manufacturing print.

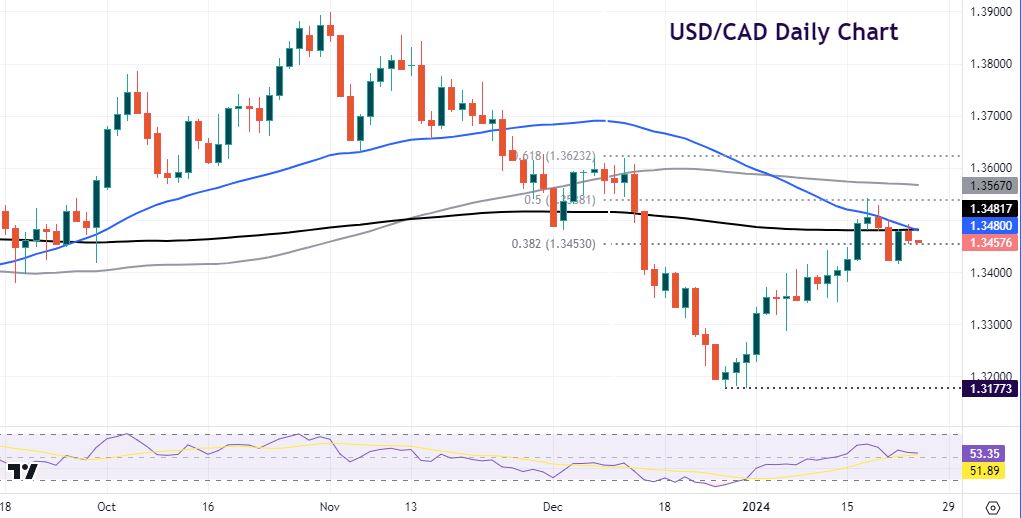

Chart of the Day – USD/CAD awaits BoC

The Bank of Canada is fully expected to keep rates unchanged at 5%. The economy is showing signs of weakness, but two measures of inflation ticked up in December so remain sticky. That means it would probably be rather surprising to hear Governor Macklem sound dovish. Caution will likely prevail and a signal that market rate cut expectations (first one in April/June) are overly aggressive is likely.

USD/CAD is trading marginally under its 50-day and 200-day SMA at 1.3481. The halfway point of the November drop is above at 1.3538. The 38.2% Fib level of that move is 1.3453.