Tech lower, BoE steady but marginally dovish

Headlines

* Bank of England holds rates at 5.25%, hints first rate cut near

* SNB cuts rate again to economy and steam gains in CHF

* USD firms on recovering risk sentiment, prospects of easier overseas rates

* Gold rises to two-week peak as Fed rate cut bets lift demand

FX: USD bounced strongly off the 50-day SMA at 105.20. Rising US yields helped with jobless claims lower than expected in the week that coincides with the NFP data collection. The recent top is at 105.80.

EUR closed on its low at 1.0701, halting the three-day win streak. The French/German (OAT/Bund) spread narrowed modestly but still remains very stretched. Monday’s swing low is at 1.0667.

GBP fell as the BoE kept rates unchanged but dropped some very marginal dovish hints in its statement. The decision was said to be “finely balanced” and some officials dismissed services inflation drivers as not likely to impact medium-term inflation. Support is a Fib level at 1.2646 with the halfway point of the April-June rally ay 1.2579.

USD/JPY broke higher and settled near session highs at 158.79. That beat the recent top at 158.25. The 10-year Treasury yield ticked up above 4.25%. USD/CHF was the laggard after the SNB cuts rates for a second time citing decreasing underlying inflationary pressures. Prices got back above the 200-day SMA at 0.8895.

AUD sold off marginally but held up relatively well. CAD strengthened for a fifth straight day with the major closing below the 50-day SMA at 1.3695.

US Stocks: Equity indices were mixed with tech leading the downside for a change. The majority of sectors were green as large cap, growth lagged while minimum volatility and defensives performed better. Energy and utilities led the gains. The S&P 500 fell 0.25% to 5,473. The Nasdaq 100 ended a seven-session streak of record closing highs. It settled off 0.79% at 19,752. In contrast, the Dow closed higher by 0.77% at 39,135. Nvidia, having recently dethroned Microsoft as the world’s most valuable public company, fell 3.5%. that pressured the main indices (S&P 500 and Nasda100) which are weighted by market value. That means the megcaps have an outsized influence on these indices.

Asian Stocks: APAC futures are in the red. Asian stocks were muted with no lead form Wall Street due to their holiday. The ASX 200 was subdued again with energy gains offset by defensive losses. The Nikkei 225 was lower with selling in heavy industries. The Hang Seng was choppy, while the mainland was tepid.

Gold broke to the upside above the 50-day SMA at 2,343. That’s the highest since the big decline on 7 June. This move could be pointing to investors still placing hedging bets against inflation and central bank policy uncertainty.

Day Ahead – PMIs

Eurozone survey data will be watched after the composite climbed to its highest in a year in May. Forecasts point to a further improvement in June’s flash estimates. The services PMI is expected at 53.6 versus the prior 53.2, and manufacturing PMI is projected to come in at 48.0 from 47.3 in May. The composite PMI is forecast to marginally tick higher to 52.5 in June from 52.2.

Investors will likely be scrutinising the details of the PMI surveys, especially sentiment, growth, inflation and wages. On employment, wage growth is still elevated so those price pressures are key. US flash PMIs have also been interesting recently. All gauges are expected to remain above the 50 mark, so softer prices could grab the market’s attention.

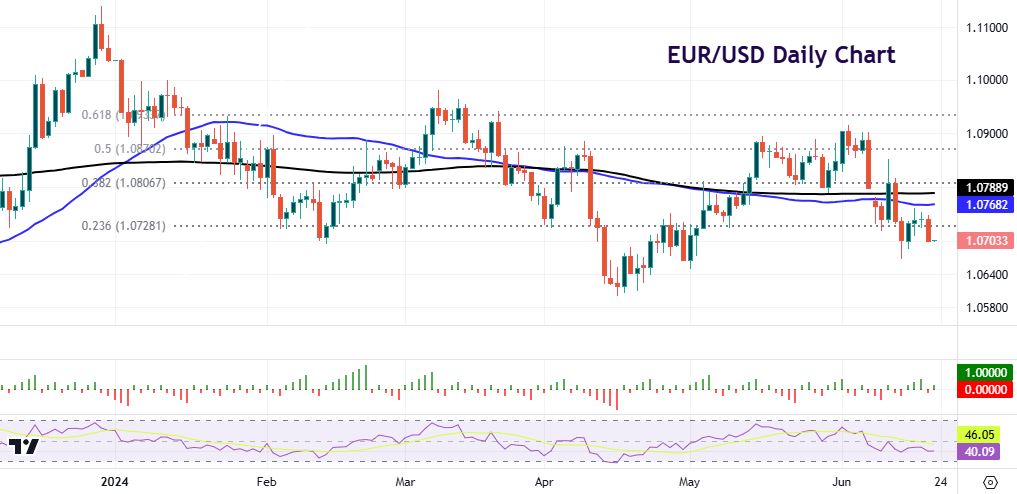

Chart of the day – EUR/USD heading lower?

Until yesterday, Euro assets were having a better week after the French snap election announcement and political chaos caused sharp uncertainty in French markets. The spread between French and German 10-year government bonds spiked to 12-year highs, though that has eased modestly lower. The ECB remains on standby. Regarding monetary policy, with a follow-up rate cut in September only 60% priced in, a soft set of PMI numbers, or signs of a cooling off in inflation, would boost those odds, potentially weighing on the euro.

Prices broke an upward trendline from the April lows 10 days ago and have also dipped below the 50-day and 200-day SMAs at 1.0768 and 1.0788. The recent swing low is at 1.0667 and the April trough at 1.0601.