Weekly Outlook | Dollar under pressure, equities rotate

Important events this week:

– CA- Consumer Price Index – The consumer price index from Canada could provide further insights into the central bank. The Canadian dollar is currently under renewed pressure and trading weaker against other currencies. If this trend continues, there could be further losses in the CAD. CPI data also came in weaker from the US last week.

The daily chart of the USDCAD currency pair could provide further insight here. The important support zone in the 1.3625 area is currently holding. If the data from Canada also comes in as expected, this could further weaken the CAD. A test of the 1.3700 zone could hence be the result. The data will be published on Tuesday, 16 July at 14:30 CE.

– UK- Consumer Price Index – Consumer prices in the UK are also due this week. A further weakening by 0.1% to 1.9% is expected. The British Pound has been soaring for the past two weeks. Further upward momentum could therefore continue.

The weekly chart shows a break of the important resistance zone at 1.2880. This could now lead to further potential and move the market higher. The next resistance zone is at 1.3130. If consumer prices continue to fall, the market might retrace lower. This could then be used for fresh entries to the upside. The data will be published on Wednesday, 17 July at 08:00 CET.

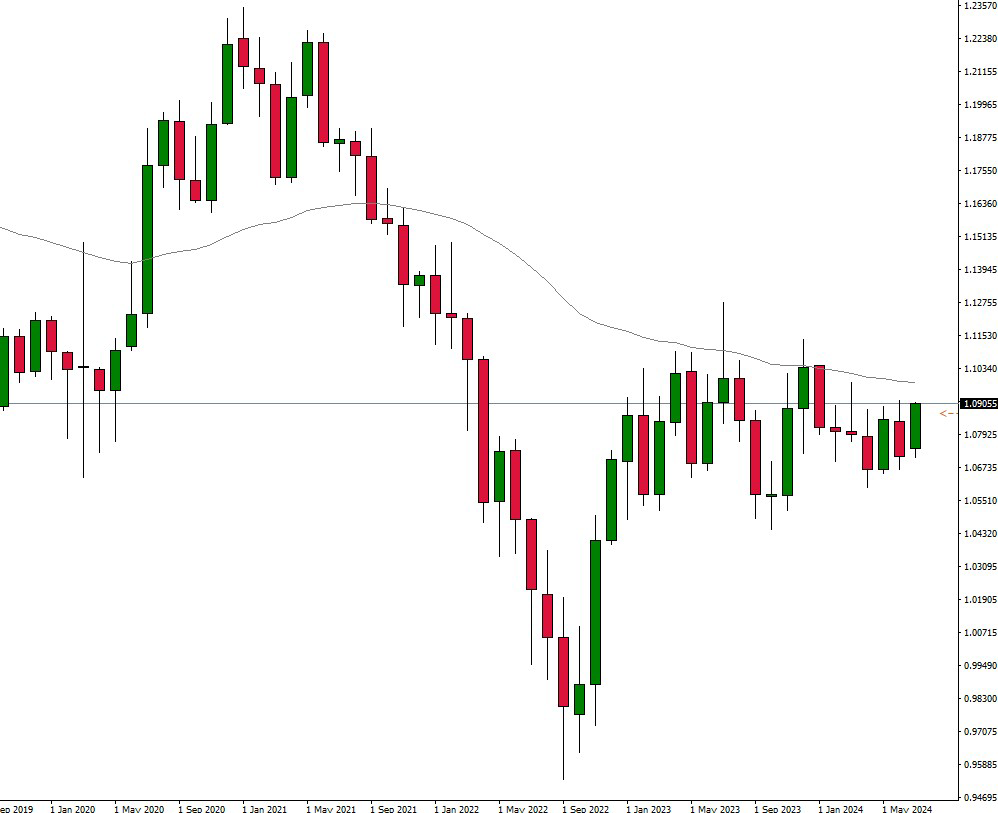

– EU interest rate decision – Last month, the European Central Bank had reduced rates. A further cut in rates is not expected this month. In any case, volatility is likely to result from this news event. The trading zone at 1.0980 could then emerge as an important level.

This is where the 50-moving average kicks in. This should indicate an important resistance area. If it is broken, further momentum towards 1.1050 could quickly materialize. The key interest rate decision will take place on Thursday, 18 July at 14:15 CET.

Big risers and fallers last week:

– Dollar remains weak – After strong potential in recent months, the Dollar could now weaken further. Falling consumer prices could then also prompt the Fed to cut interest rates. This expectation is currently weakening the Greenback against other currencies.

– Stock markets at a crossroads – equities are currently not showing much volatility. On the other hand, there was a rotation in the sectors last week. Strong technology stocks, such as Nvidia, came under renewed pressure. This caused the Nasdaq- 100 to fall after consumer prices in the US weakened. The German DAX and the Dow Jones Index were able to gear up momentum again. Falling interest rates in the US could further supprt this trend.