Weekly Outlook | Inflation data and Central Bank Decisions to shape markets

Last week, the Reserve Bank of New Zealand slashed its OCR by 50bps to 4.75%, in line with forecasts, while U.S. CPI rose 0.2% MoM, beating expectations. The Dollar hence geared up further momentum. U.K. GDP edged up 0.2% and Canada’s unemployment dropped to 6.5%, defying projections. Gold rallied to USD 2,650 as mixed U.S. inflation data shaped Fed policy sentiment, and WTI crude settled at USD 75.00, pressured by Middle East tensions and Hurricane Milton’s effect on fuel demand.

Important events this week

Canada Inflation Rate MoM : On Tuesday October 15th 2024 at 12:30 pm GMT, Canada will be announcing it’s CPI MoM forecasted at -0.2%.

The Canadian CPI decreased by 0.2% over a month in August 2024, compared to expectations for a flat reading, following a 0.4% rise in the prior month.

The USDCAD daily chart shows a potential resistance breakout at 1.3780. If confirmed, the pair could rally toward 1.3950. However, if the breakout fails, downside risks may push the exchange rate toward 1.3640.

New Zealand Inflation Rate QoQ

On Tuesday, October 15th, 2024, at 21:45 GMT, New Zealand will release its Q3 inflation data, with a forecast of 1.9% QoQ. This follows a 0.4% CPI rise in Q2, down from 0.6% in Q1.

A potential resistance rejection has been identified on the NZDUSD daily chart at 0.6105. If the rejection holds, the pair could drop toward 0.5970. However, if the rejection fails, the exchange rate may rise toward 0.6175.

UK Inflation Rate

On Wednesday, October 16th, 2024, at 6 AM GMT, the UK will release its YoY CPI, forecasted at 1.9%. This follows stable inflation at 2.2% in both July and August, aligning with market expectations.

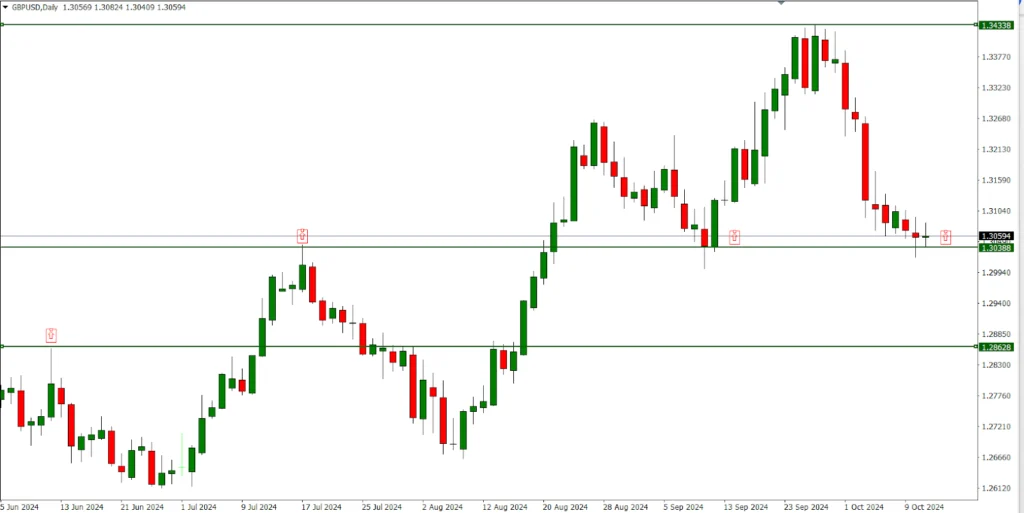

The GBPUSD daily chart shows potential support rejection at 1.3030. If the rejection holds, the pair could rally toward 1.3430. However, if the support fails, the exchange rate may decline to 1.2860.

ECB Interest Rate decision

On Thursday, October 17th, 2024, at 12:15 PM GMT, the ECB is set to announce its main refinancing rate, forecasted at 3.40%. This follows a 25bps cut to the deposit facility rate in September to 3.5%, after a similar June reduction from 4.50% to 4.25%.

The EURUSD daily chart indicates potential support rejection at 1.0900. If this rejection holds, the exchange rate could rally to 1.0990. Conversely, if the rejection fails, the pair may drop toward 1.0770.

U.S. Retail Sales

On Thursday, October 17th, 2024, at 12:30 PM GMT, the U.S. will release its MoM retail sales, forecasted at 0.3%. This follows a 0.1% increase in August, following a revised 1.1% rise in July, which surpassed expectations of a 0.2% decline, indicating robust consumer spending.

The weekly chart of the USDJPY pair indicates a potential resistance breakout at 149.36. If this breakout holds, the exchange rate could surge toward 155.21.

One crucial point is the 50- moving average which has been broken to the upside indicating potential positive momentum ahead.