Weekly Outlook | Jerome Powell guiding markets

Important news events this week:

This trading week is likely to continue to be dominated by information from Jerome Powell. The head of the US Federal Reserve announced that it is now time to reduce interest rates. Last weekend also saw the meeting in Jackson Hole, which is usually attended by central bankers from many countries.

Prior to this, there were slight signs of profit-taking on Thursday last week due to the expected uncertainty, but these were then recovered by Friday. In particular, the renewed weakness of the US dollar following Jerome Powell’s statements on Friday then provided new upward potential.

– US – Unemployment claims – There is very little important data on the agenda this week. However, the labor market data on Thursday could again move the markets slightly positively. The US dollar was able to move positively around the news event last week. The data was in line with expectations. This was then seen as positive by market participants, as the data was not weaker, which would have indicated further weak US economic data.

A look at the weekly chart of the GBPUSD shows that the positive trend may continue. Should there be better than expected figures, the Dollar could show renewed potential and thus move the currency pair lower. On the other hand, downward setbacks could also provide new entry points for fresh long positions. The data will be published on Thursday, 29 August at 14:30 CET.

– US – PCE Deflator – The price indicator is expected to come in at 0.2% again this month. Although this continues to serve as a source of data for the Fed for the coming interest rate trend, it may be less important in this period. Fed Chairman Powell announced last week that it is now time to reduce interest rates. The focus is now shifting more towards the labor market data, as described above.

However, another slight rise in the indicator could slightly strengthen the Dollar again, as the expectation could be that the Fed will reduce interest rates less this year.

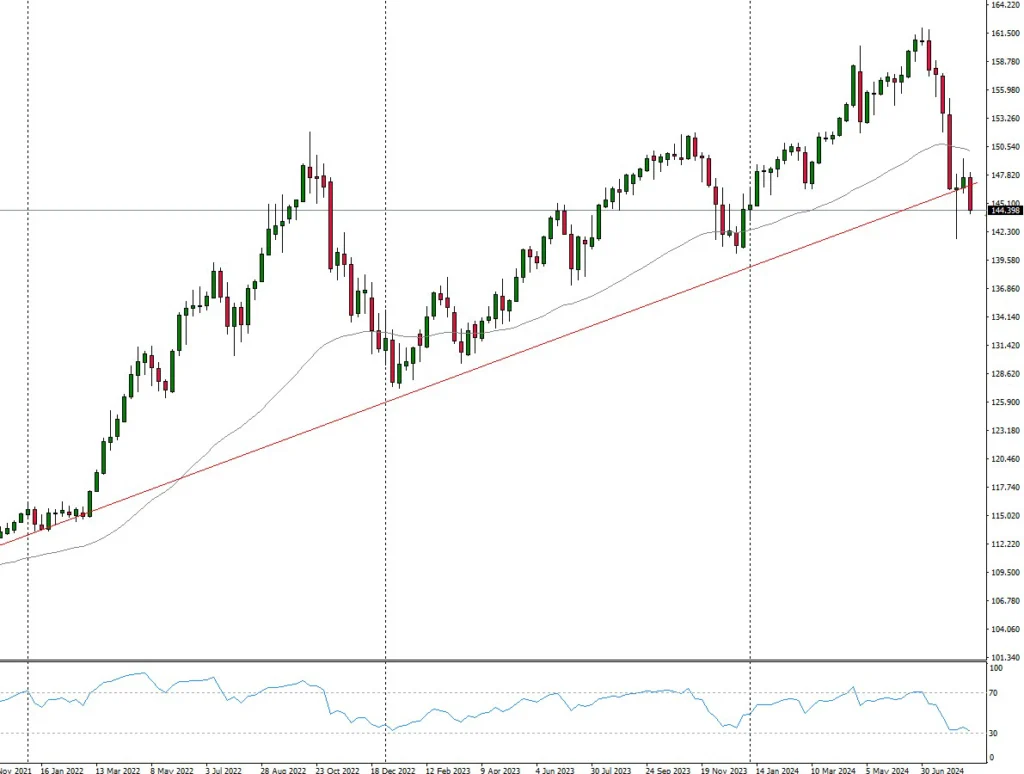

A look at the USDJPY currency pair shows that the market is currently at a crossroads. If the current downward trend is resumed, there could quickly be potential to move towards the USD 140.00 zone.

On the other hand, the market is currently at a good support zone. If this is not broken to the downside, there could be a further setback to the upside. The price index will be published on Friday, 30 August at 14:30 CET.