Weekly Outlook | Key indicators and market effects following a strong NFP report.

Important events this week:

Markets continue to trade with the influence of the strong NFP data from last week. The figure came in much stronger causing the Dollar to gear up some momentum. Stock markets on the other hand did not lose momentum, potentially fueled by the expectation that the Fed will be on the correct path to lower interest rates even further. Oil prices continue to be influenced by geopolitical tensions form the Middle East.

New Zealand Interest Rate – The RBNZ will announce its interest rate decision on Wednesday October 9, 2024, at 1:00 am GMT, with a forecasted cut from 5.25% to 4.75%. In August 2024, the bank unexpectedly lowered the OCR by 25 basis points to 5.25%, its first reduction since March 2020, after nine consecutive holds.

On the NZDUSD weekly chart, bearish pressure was evident and the market closed at 0.6154. Although it traded above the 50 MA, a break below the uptrend line at 0.6287 indicates a possible trend reversal towards the 0.5850 zone.

U.S Inflation Rate ( CPI ) MoM – The US CPI for October 2024 is set for release on Thursday, 10th at 12:30 pm GMT, with a forecast of 0.1%. In August 2024, CPI ticked up 0.2% MoM, matching July’s figure.

The USDCAD weekly chart showed bullish momentum closing at 1.3573. Despite a bearish signal from the 50 MA, the bounce from the uptrend line at 1.3418 indicates upside potential. If this support holds, targets of 1.3650 and 1.3950 are possible. A breakout above the 50 MA would confirm continued bullish momentum.

U.K Monthly GDP – On Friday, 11 October 2024, at 6:00 am GMT, the UK is set to release its monthly GDP data, with a forecast of 0.2%. The economy stagnated in July 2024, mirroring June’s flat growth and missing the expected 0.2% uptick.

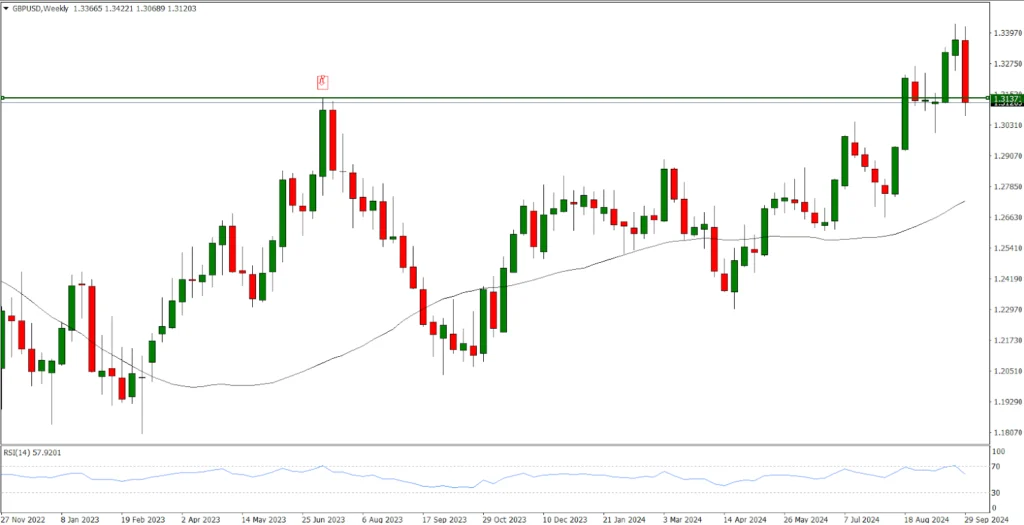

The GBPUSD weekly chart reflects a strong bearish trend closing at 1.3117. Although it remains above the 50 MA, the breach of the previous support at 1.3137 suggests a possible downside reversal. Continued downward momentum could target levels near 1.2660 and 1.2290, with a dip below the 50 MA increasing the risk of further declines.

Canada Unemployment Rate – Canada’s October 2024 unemployment rate, set for release on Friday October 11, 2024 at 12:30 pm GMT, is forecasted at 6.6%. In August 2024, the rate spiked to 6.6%, up from 6.4%, breaching market estimates of 6.5% and hitting the highest since October 2021.

The USDCAD weekly chart shows upward momentum with a high of 1.3591. Despite the bearish pressure from the 50 MA, the rebound off the uptrend line at 1.3418 indicates potential for a rally. If this support holds, targets could be set at 1.3645 and 1.3945, with a breakout above the 50 MA confirming a bullish trend continuation.